Blog / Cross-Channel Data Integration for Journeys

Cross-Channel Data Integration for Journeys

Want to connect with your customers across every channel? Cross-channel data integration is the solution. It combines data from platforms like websites, apps, and in-store systems into a single, actionable view, enabling businesses to deliver personalised customer experiences.

Key Highlights:

- Unified Data: Avoid disconnected touchpoints by integrating data from multiple sources like CRM, POS, and social media.

- Customer Expectations: 72% of consumers expect businesses to recognise their preferences, making unified data crucial for personalisation.

- UAE Context: With 99% internet penetration and AED 38.8 billion projected in e-commerce by 2029, UAE businesses must prioritise integration.

- Success Stories: UAE brands like TKD Lingerie and Anigma Technologies have achieved higher returns and customer growth by centralising data.

- Implementation Steps: Audit your data sources, resolve customer identities, and create workflows for real-time data movement.

Why It Matters:

Integrated data eliminates missed opportunities, ensures consistent messaging, and meets the high expectations of UAE's tech-savvy customers. Ready to move beyond fragmented systems? Start by mapping your customer journey and centralising your data for better engagement and results.

Which Methods Ensure Cross-Channel Customer Data Sync?

Auditing Your Data Sources and Channels

Before diving into integration, take a close look at your data systems. Many UAE businesses gather customer interactions from 15 to 20 different platforms, ranging from WhatsApp chats to POS terminals in places like Dubai Mall. With so many apps - each using its own data format - failing to audit these systems first could lead to duplicate records, missed opportunities, or compliance troubles.

Start by mapping the customer journey to identify every data touchpoint. This includes pinpointing the system behind each interaction, whether it’s your CRM, POS software, email marketing tools, helpdesk platforms, or web analytics. Don’t overlook digital exhaust (like browsing history or location data) and offline interactions, such as in-store visits. Every touchpoint matters.

This process requires teamwork. Marketing typically oversees email and social platforms, Sales handles the CRM, IT manages databases and APIs, and Operations runs POS systems. Data silos are a common challenge, with 80% of IT departments citing them as a major issue. Collaborating with department heads early can help uncover hidden data sources and clarify access permissions. This audit is the first step toward creating a unified data model.

Cataloguing Customer Touchpoints

Once you’ve mapped the customer journey, catalog all touchpoints and their associated data systems. Digital channels like websites, mobile apps, and social media provide real-time data through APIs, using identifiers such as cookie IDs, device IDs, and IP addresses. Direct marketing platforms, like email and SMS tools, track interactions via email addresses and phone numbers.

Physical touchpoints are just as critical. POS systems and in-store loyalty programmes rely on identifiers like loyalty IDs or credit card tokens, though their data is often updated in daily or weekly batches. Customer service systems, such as helpdesks and call centres, generate ticket IDs tied to phone numbers or emails in real time. Internal systems like CRMs, ERPs, and databases store customer IDs and account numbers, accessible through real-time change data capture (CDC) or periodic exports. IoT devices and smart systems add another layer, streaming data tied to serial numbers or MAC addresses.

As you document each source, note the types of data collected (e.g., demographics, transaction history, behavioural logs) and the identifiers used (e.g., email, phone number, Emirates ID, loyalty card). This step is essential for identity resolution - linking scattered interactions into a single customer profile. Standardising naming conventions early is crucial; inconsistent labels like "user_signed_up" versus "Sign-up" can create problems later on.

Assessing Data Ownership and Quality

With your touchpoints catalogued, the next step is to evaluate the quality of your data to ensure smooth integration. Use these five criteria to assess each source:

- Accuracy: Is the data reliable and error-free?

- Completeness: Are key fields, like email or phone numbers, fully populated?

- Consistency: Is the same customer represented the same way across systems?

- Timeliness: How recently was the data updated?

- Conformity: Does the data align with your internal standards?

Data profiling tools can help you spot issues like missing values, duplicate records, or formatting inconsistencies. For example, your CRM might have outdated contact details or duplicate entries, while e-commerce systems might lack data from guest checkouts. Web analytics could be skewed by bot traffic or anonymous users, and email platforms might show high bounce rates or unclear opt-in statuses. Customer support systems often contain unstructured text, making analysis more complex.

In the UAE, ensure your audit complies with the Digital Data Interoperability Principles and Standards set by the Telecommunications and Digital Government Regulatory Authority (TDRA). According to the TDRA:

"The Digital Data Interoperability Principles and Standards aim to enhance the quality of data interoperability on a national level. It ensures efficient digital data sharing between government entities... and provide a common basis for the use, reuse, and exchange of government digital data."

Focus on first-party data - information you’ve collected directly, such as website activity, purchase history, and contact details. This is your most reliable foundation. Determine which sources can be integrated right away and which need cleaning or even retirement. Since employees spend up to 30% of their time searching for and preparing data, automating tasks like validation and deduplication can save significant time.

Comparison Table: Data Sources Audit

| Data Source | Common Identifiers | Data Timeliness | Typical Quality Issues |

|---|---|---|---|

| CRM | Email, Phone, Name | Daily/Real-time | Duplicate records, outdated contact info |

| E-commerce/POS | Customer ID, Email | Real-time | Gaps from guest checkouts, missing return data |

| Web Analytics | Cookie ID, IP Address | Real-time | Anonymous profiles, bot traffic |

| Email Marketing | Email Address | Batch/Daily | Bounce rates, inconsistent opt-in status |

| Customer Support | Phone, Email, Ticket ID | Real-time | Unstructured text, sentiment gaps |

This table can guide your integration priorities. Focus first on sources with strong identifiers and real-time data. Those with quality issues may need cleaning before they’re added to your unified system.

Designing a Unified Data Model and Identity Resolution Strategy

Once you've completed your data audit, the next step is creating a unified data model to streamline all customer interactions. A unified data model acts as a framework for organising customer information from various sources - your CRM, website, POS systems, and email platforms - into one consistent structure. Without this, customer recognition becomes fragmented, leaving 71% of consumers dissatisfied with personalisation efforts.

Building a Customer Data Model

At its core, your data model should focus on three primary entities: Customer, ExperienceEvent, and Commerce.

- The Customer entity includes essential identity details like name, email, phone number (formatted for the UAE: +971 5X XXX XXXX), and language preferences (Arabic or English).

- ExperienceEvent tracks behavioural data such as website visits, app usage, or in-store browsing. Adding timestamps ensures you can follow the sequence of actions.

- Commerce contains transaction details, including

currencyCodeset to AED,priceTotal, and product SKUs.

Standardising these fields helps avoid confusion caused by inconsistent naming. For instance, if your e-commerce system labels purchases as "order_complete" but your POS system uses "transaction_final", your analytics won't give you a full picture. For businesses in the UAE, it's also important to include location data to account for regional differences between Dubai, Abu Dhabi, and other emirates. Ensuring consistency in formats - like dates and phone numbers - keeps your data clean and actionable.

Whenever possible, use streaming data ingestion to enable real-time actions. Real-time updates allow you to respond instantly, such as sending a cart abandonment reminder within minutes rather than waiting for a batch process. To make this work, define primary identifiers upfront - like email addresses or loyalty IDs - and establish identity namespaces to connect time-series data to individual profiles.

Once your data model is in place, the next step is to unify fragmented customer profiles through identity resolution.

Implementing Identity Resolution

Identity resolution brings together fragmented profiles from different systems to create a single, unified view of the customer. Imagine a customer browsing your website anonymously, signing up for a newsletter with an email, making an in-store purchase with a loyalty card, and reaching out to support via WhatsApp. Identity resolution ensures all these touchpoints are linked to one profile.

Deterministic matching is the most reliable method. It connects records using exact identifiers such as email addresses, phone numbers, or loyalty IDs. For example, if your CRM lists "[email protected]" and your e-commerce system logs the same email, you can confidently merge these profiles. This method works best when customers authenticate themselves by logging in or providing contact details. For UAE businesses, standardising phone numbers to the local format (+971...) helps avoid mismatches.

Heuristic (probabilistic) matching relies on algorithms to identify patterns when exact identifiers aren’t available. It might connect profiles based on similar IP addresses, device types, or browsing behaviours. While this method can help link anonymous sessions to known users, it carries a risk of errors - merging profiles that don’t belong together. Use this approach cautiously, especially for sensitive data like financial or transactional records, where accuracy is critical.

Another key aspect is stitching anonymous data to known profiles. For instance, a visitor’s activity might be tracked via cookies when they browse your site anonymously. Once they sign up or make a purchase, you can link their previous anonymous activity to their authenticated profile, creating a complete customer journey. However, in the UAE, ensure proper consent is obtained before merging such data, in line with local data protection laws.

The following table compares the main techniques for identity resolution:

Comparison Table: Identity Resolution Techniques

| Technique | Method | Accuracy | Best Use Case | Limitations |

|---|---|---|---|---|

| Deterministic Matching | Links records using exact identifiers (email, phone, loyalty ID) | Very high - 100% when identifiers match | Connecting CRM profiles to POS transactions or email campaigns | Fails when customers check out as guests or change contact details |

| Heuristic (Probabilistic) Matching | Uses algorithms to find patterns across IP addresses, device types, and behaviour | Moderate - relies on probability and statistical confidence | Linking anonymous website visitors to previous browsing sessions | Risk of false positives; lower precision for high-stakes data |

Start with deterministic matching for high-value customer segments like loyalty programme members, repeat buyers, and authenticated users. Save probabilistic techniques for broader analysis, such as understanding anonymous browsing behaviour, where perfect accuracy isn’t as critical.

sbb-itb-058f46d

Implementing Cross-Channel Data Integration Workflows

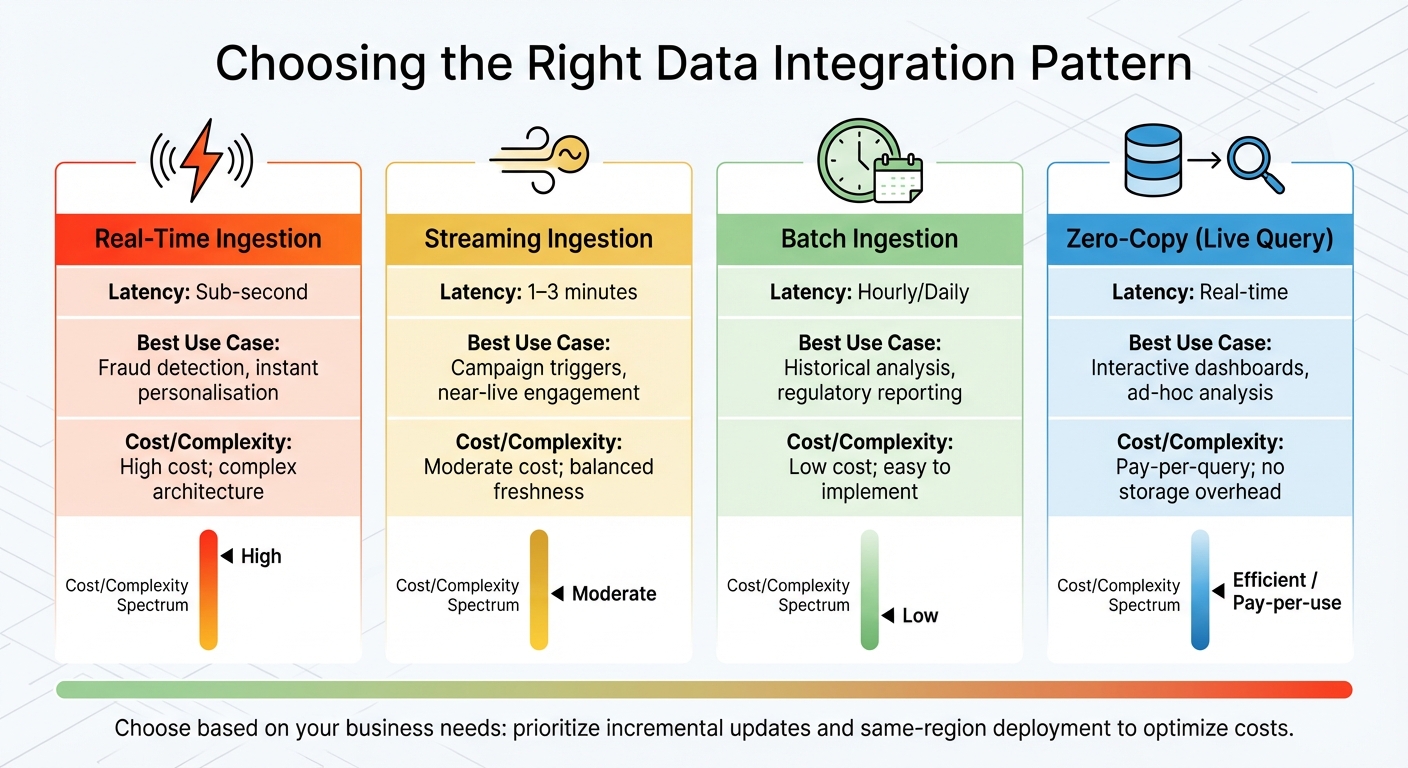

Data Integration Methods Comparison: Batch vs Streaming vs Real-Time vs Zero-Copy

Once you've established a unified data model and resolved customer identities, the next step is creating workflows that enable smooth data movement across channels. This involves directing data from sources like your website, mobile app, in-store POS systems, or CRM into a central repository. This centralisation is essential for delivering personalised customer experiences.

Choosing the Right Integration Pattern

The integration pattern you choose determines how data flows between systems. Here are the main options:

- Batch ingestion: This method processes data on a set schedule, such as hourly, daily, or weekly. It's ideal for tasks like generating monthly sales reports in AED or other historical analyses.

- Streaming ingestion: With data processed every 1–3 minutes, this strikes a balance between freshness and complexity. It's perfect for near-live engagements, such as sending an SMS for an abandoned cart shortly after a customer leaves your site.

- Real-time ingestion: Operating with sub-second latency, this approach is essential for critical tasks like fraud detection or immediate personalisation. However, it comes with higher costs and added architectural complexity.

- Zero-Copy federation: Instead of moving or duplicating data, this method queries external data lakes (like Snowflake or BigQuery) directly. It's a cost-effective solution for integrating large, frequently updated datasets, as it reduces storage needs and latency. By pushing filters and aggregations to the source system, you also minimise data movement over the network.

| Integration Method | Latency | Best Use Case | Cost/Complexity |

|---|---|---|---|

| Real-Time Ingestion | Sub-second | Fraud detection, instant personalisation | High cost; complex architecture |

| Streaming Ingestion | 1–3 minutes | Campaign triggers, near-live engagement | Moderate cost; balanced freshness |

| Batch Ingestion | Hourly/Daily | Historical analysis, regulatory reporting | Low cost; easy to implement |

| Zero-Copy (Live Query) | Real-time | Interactive dashboards, ad-hoc analysis | Pay-per-query; no storage overhead |

To optimise costs and efficiency, always prioritise incremental updates over full data reloads. Additionally, aligning your data ingestion pipelines and storage within the same cloud region can help reduce latency and avoid unnecessary egress charges.

Once you've selected an integration pattern, focus on designing robust pipelines to validate, transform, and store your data effectively.

Designing Data Pipelines

A well-structured data pipeline includes four key stages: ingestion, validation, transformation, and storage. Here's a closer look at each stage:

- Ingestion: Gather data from various sources - such as APIs or pre-built connectors for your e-commerce platform, loyalty programme, or in-store POS systems.

- Validation: Check that incoming records meet your schema requirements. For example, confirm that phone numbers follow the UAE format (+971 5X XXX XXXX), dates use the DD/MM/YYYY format, and currency fields are in AED. Strong validation rules help catch issues like missing emails or incorrect amounts early.

- Transformation: Standardise data into a consistent format. For instance, if your CRM refers to completed purchases as "order_complete" but your POS system uses "transaction_final", harmonise these into a single event name. Consistency in fields and timestamps is crucial.

- Storage: Save the processed data in a central repository or Customer Data Platform (CDP). Using Parquet as the file format is recommended for handling large-scale datasets efficiently. Organise your data around key entities like Customer, ExperienceEvent, and Commerce for consistency across touchpoints.

To reduce manual errors and improve efficiency, automate your transformation scripts. Additionally, implement Change Data Capture (CDC) to track and ingest only updated records in near real-time. This approach stabilises resource usage and ensures your data remains current.

With your pipelines in place, it's essential to embed compliance and consent management into your workflows.

Ensuring Compliance and Consent Management

In the UAE, data integration workflows must respect consent preferences across all channels - whether a customer opts in via your website, mobile app, or an in-store kiosk.

Integrate privacy preferences directly into your pipelines. For example, if a customer revokes consent for marketing emails, this change should instantly update across your CRM, email platform, and analytics tools. Automating consent management ensures you can handle "forget me" requests promptly and remain compliant with UAE privacy regulations.

Classify your data based on its sensitivity - like openness, confidentiality, or secrecy - to ensure secure exchanges. In regulated industries such as Open Finance, providers are restricted from processing "Sensitive Data" (e.g., health or genetic information) even with explicit consent. Use data masking and robust security measures to meet regional data residency and confidentiality standards.

Keep detailed records of data flows, transformations, and consent updates to maintain auditability. This allows internal teams and UAE authorities, such as the Central Bank of the UAE (CBUAE), the Securities and Commodities Authority (SCA), or the Dubai Financial Services Authority (DFSA), to conduct reviews. Establish clear plans for data recovery or migration in case a vendor relationship ends.

Finally, be transparent about using technologies like AI and Big Data. Provide clear, straightforward disclosures, and conduct regular audits of your data pipelines to ensure ongoing compliance with UAE privacy laws.

Activating and Optimising Customer Journeys

With unified customer data at your fingertips, you can design customer journeys that genuinely connect. Instead of relying on generic campaigns, these journeys adapt to real customer behaviour, potentially increasing revenue by 5% to 15%.

Mapping Data-Driven Journeys

Start by visualising how customers interact with your brand - from discovering you on Instagram to visiting your website, stopping by your Dubai store, and eventually completing a purchase. This approach highlights key transitions. For instance, if a customer abandons their cart on a mobile device, a bilingual push notification could be triggered to re-engage them.

"The most effective omnichannel customer journey provides more than multiple channels for interaction - it offers a unified experience, with each channel complementing the others and maintaining cohesion."

Focus on impactful journeys first. A "Welcome Series" for new subscribers or an "Abandoned Cart Recovery" flow often yields quick wins. Define critical stages and assign triggers. For example, when a customer enters a geofenced area near your Mall of the Emirates location, send them a push notification with a limited-time offer in AED. Real-time orchestration like this transforms passive data into active engagement.

Emotional connection is equally important. UAE consumers demand seamless experiences, and 92% of marketing leaders agree that consistency across online and offline channels is essential. If a customer contacts your call centre, agents should have access to their recent browsing activity and purchase history. This eliminates friction and fosters trust in a market where efficiency is highly valued. These steps lay the foundation for precise performance tracking.

Measuring and Improving Performance

After activating customer journeys, tracking their performance is key. Measure conversion rates, average order value (AOV in AED), and customer lifetime value (CLV) to assess ROI. Multi-touch attribution can help you understand which channels contribute most to sales. For example, a customer might see a Facebook ad, browse your website, and return via a Google search to complete a purchase. While last-click attribution credits only the search, multi-touch attribution reveals the entire journey.

Analyse customer flow to identify friction points. If cart abandonment spikes during payment, investigate whether bilingual navigation issues or a lack of trust signals for local payment methods are causing the problem.

Create continuous feedback loops by reviewing journey performance weekly rather than quarterly. For example, if email open rates fall below the 21.33% average, test new subject lines or adjust the timing of your emails. Similarly, if push notification click-through rates stagnate, experiment with personalised content based on browsing history or location. Regular tweaks through a central decision engine ensure consistent improvement.

Comparison Table: Integrated vs Siloed Journeys

The table below highlights how integrated data transforms customer experiences compared to isolated channel strategies.

| Feature | Siloed (Single-Channel) Approach | Integrated (Omnichannel) Approach |

|---|---|---|

| Customer View | Fragmented; customer seen as different IDs per channel | Unified; single 360-degree profile across all touchpoints |

| Messaging | Inconsistent; often contradictory or repetitive | Cohesive; messages adapt based on previous interactions |

| Data Latency | High; data updated in batches, leading to missed opportunities | Real-time; triggers respond instantly to customer actions |

| Measurement | Last-click attribution; fails to capture the full path | Multi-touch attribution; tracks every interaction's ROI |

| Operational Efficiency | Manual coordination; high operational friction | Automated orchestration; "set and forget" workflows |

The contrast is clear. Marketers who use three or more channels in a coordinated journey achieve a 494% higher order rate. In the competitive UAE market, where 92% of consumers have shifted towards digital shopping experiences, integrated journeys are not just beneficial - they are essential.

Conclusion

Integrating cross-channel data is revolutionising how businesses in the UAE engage with their customers, paving the way for personalised experiences that deliver measurable outcomes. In fact, tailored customer journeys have the potential to boost revenue by 5% to 15%.

This approach is especially crucial in a market defined by high digital activity. With 84% of customers using multiple communication channels to complete a single transaction and 92% placing equal importance on the experience as they do on the product, seamless integration is no longer optional - it's a necessity. The UAE's digital environment, marked by 99% internet penetration and an e-commerce market projected to hit AED 38.8 billion by 2029, underscores the importance of recognising and connecting with customers across every touchpoint.

To achieve this, trusted frameworks provide the foundation for success. As highlighted earlier, Wick's Four Pillar Framework is a comprehensive guide for businesses, covering everything from data collection through website development and content strategies to centralised storage and AI-driven personalisation. By unifying marketing, sales, and customer support efforts, this framework creates a single, reliable source of truth that enhances every customer interaction.

Start small with impactful actions that can grow over time. Implement initiatives like abandoned cart recovery flows or welcome series for new subscribers to gain momentum. As your system evolves and your data becomes more interconnected, customers will notice the seamless experience, and your business will benefit from stronger loyalty and improved conversion rates.

FAQs

How can businesses in the UAE ensure compliance with local data protection laws when integrating data across channels?

Complying with the UAE's Personal Data Protection Law (PDPL) requires businesses to adopt both legal and technical safeguards during data integration. Here's what you need to know:

- Obtain Explicit Consent: Always secure clear, informed consent from individuals before collecting or processing their personal data. Keep detailed records of these consents for accountability.

- Conduct a Data Protection Impact Assessment (DPIA): This step is crucial, especially when employing AI technologies or transferring data across borders. It helps identify and mitigate potential risks.

- Cross-Border Data Transfers: Use approved methods like explicit consent or contractual agreements to ensure data protection aligns with UAE regulations.

Strengthening Data Security

To stay compliant, appointing a Data Protection Officer (DPO) is highly recommended. The DPO can oversee privacy policies and ensure all practices meet legal requirements. Additionally, businesses should implement strong security measures, including:

- Encryption to protect data during storage and transfer.

- Access controls to limit data visibility to authorised personnel only.

- Continuous monitoring to maintain data integrity and confidentiality.

How Wick Can Help

Wick offers tailored solutions to help UAE businesses create unified data ecosystems that meet PDPL requirements. Their services include:

- Drafting privacy policies that align with UAE standards.

- Conducting DPIAs to identify and manage risks effectively.

- Providing secure data storage and processing solutions.

With Wick’s expertise, businesses can ensure a seamless and compliant digital experience for their customers while safeguarding personal data.

What are the main advantages of using deterministic matching instead of heuristic matching for identity resolution?

Deterministic matching stands out for its precision and reliability in identity resolution. By using exact data points - like email addresses or phone numbers - it links customer identities across different channels with a high degree of accuracy. This method significantly reduces errors and minimises the chances of incorrect associations.

On the other hand, heuristic (or probabilistic) matching depends on patterns and probabilities, which can occasionally result in less precise outcomes. Deterministic matching is especially useful for building a unified and consistent view of the customer journey, making it a perfect fit for data-driven marketing strategies in fast-evolving markets like the UAE.

How does integrating data across channels enhance customer journey personalisation?

Integrating data from various channels helps create a complete picture of each customer by bringing together interactions from websites, mobile apps, social media, and offline activities. This approach allows businesses to gain a deeper understanding of customer preferences, purchase history, and real-time behaviour. The result? Consistent and personalised experiences across all platforms. Imagine sending an email that references an in-store purchase or a push notification offering a location-based discount based on previous shopping habits.

For businesses in the UAE, this strategy is even more impactful when it aligns with local practices. This could mean offering Ramadan-specific promotions, using Arabic-language content, or respecting regional data privacy standards. Presenting prices in AED (e.g., AED 1,250) and using tools like AI-powered personalisation ensures that customer journeys feel seamless and relevant. Wick supports this integration with its Four-Pillar Framework, enabling brands to build cohesive digital ecosystems designed specifically for the UAE market.