Blog / Ultimate Guide to Data Analytics for Gulf Businesses

Ultimate Guide to Data Analytics for Gulf Businesses

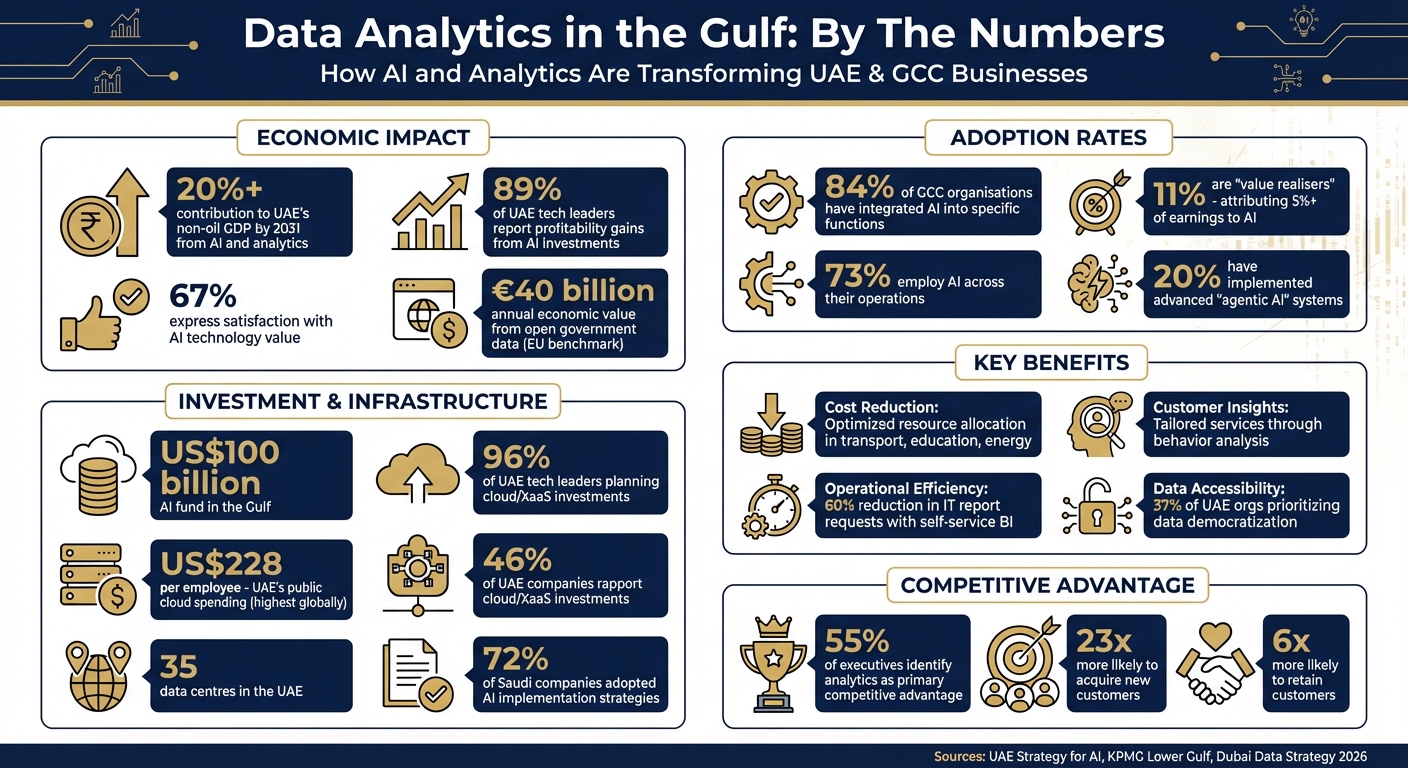

Data analytics is reshaping businesses in the Gulf, especially in the UAE, by turning raw data into actionable insights. With government initiatives like Vision 2031 and the UAE Strategy for Artificial Intelligence, analytics is now integral to sectors such as banking, healthcare, energy, and retail. Key highlights:

- AI Impact: By 2031, AI and analytics will contribute over 20% to the UAE’s non-oil GDP.

- Profitability: 89% of UAE tech leaders report gains from AI investments.

- Government Support: Programmes like Dubai Data Strategy and the National Digital Government Strategy drive analytics adoption.

- Tools & Training: Cloud platforms (AWS, Azure) and user-friendly tools (Power BI, Tableau) simplify implementation. Workforce training ensures seamless integration.

- Compliance: Strict data protection laws (PDPL, DIFC, ADGM) ensure secure analytics practices.

Data analytics reduces costs, improves customer understanding, and enhances operational efficiency. With robust infrastructure and government backing, Gulf businesses are well-positioned to thrive in a data-driven future.

Data Analytics Impact on Gulf Businesses: Key Statistics and Benefits 2026

The Value of Big Data | Data and Analytics | KPMG

Why Gulf Businesses Need Data Analytics

Gulf businesses often grapple with high costs, limited resources, and productivity hurdles. Data analytics offers a way to tackle these challenges head-on by cutting expenses, boosting efficiency, and unlocking growth opportunities. Government initiatives further highlight the importance of analytics in addressing these pressing issues.

Government Programmes Supporting Digital Transformation

Government support plays a crucial role in driving digital transformation. The UAE Strategy for Artificial Intelligence, launched in October 2017, aims to position the UAE as a global leader in AI investment, laying the groundwork for businesses to thrive in a data-driven environment.

These programmes deliver real-world benefits. For example, analytics have been used to cut costs in transportation, improve healthcare outcomes, and optimise resources in sectors like water management and technology. The government's push towards a "post-mobile government" phase - where services increasingly rely on AI and advanced analytics - further underscores the shift to smarter, data-led solutions.

Aligning business data strategies with national initiatives allows organisations to leverage the UAE's growing digital infrastructure. In 2020, the UAE ranked first globally in 23 key indicators, including mobile network coverage and the absence of bureaucratic hurdles, providing businesses with a strong foundation for adopting data-driven practices.

Market Growth in the Gulf Region

Government backing has created fertile ground for analytics-driven market growth. According to recent data, 89% of UAE tech leaders report that their AI investments have been profitable, with 67% expressing satisfaction with the value these technologies bring to their organisations.

"By prioritising data-driven strategies and leveraging cloud platforms, UAE tech leaders are transforming challenges into opportunities for sustained growth and efficiency."

- Mohamad Majid, Partner - Advisory, KPMG Lower Gulf

The infrastructure supporting this growth is impressive. Leading cloud providers like AWS and Azure have established local data centres in the UAE, allowing businesses to manage large data volumes efficiently while ensuring data sovereignty and low-latency analytics. Looking ahead, 76% of UAE tech leaders anticipate that AI will revolutionise knowledge creation and best practices, signalling a continued commitment to innovation and investment.

Main Benefits of Data Analytics for Gulf Businesses

Data analytics offers Gulf businesses several advantages, from cutting costs to improving customer understanding and operational efficiency.

Cost reduction is one of the most immediate benefits. In sectors like transport and education, analytics help optimise resource allocation and reduce accidents, while in areas like space exploration, they enhance accuracy and minimise expensive experimental errors.

Customer insights are another major advantage. By analysing open government data and consumer behaviour trends, businesses can deliver tailored services that improve customer satisfaction. This aligns with the UAE's broader digital transformation goals, where enhancing customer happiness remains a key focus. For perspective, the World Bank estimates that open government data generates up to €40 billion annually in economic value across the European Union.

Operational efficiency also sees a significant boost with analytics. By integrating smart digital systems, businesses can address complex challenges quickly and effectively, improving performance across all levels of the organisation. The growing emphasis on data democratisation - with 37% of UAE organisations prioritising data accessibility in the next 12 months - ensures that insights are delivered to decision-makers promptly, enabling swift responses to market demands.

Additionally, scalability becomes far more achievable through cloud-first strategies. Companies can start small, expanding their analytics capabilities as they grow without the need for substantial upfront investments. This flexibility is especially valuable for businesses navigating the region's rapidly changing economic landscape while building a solid foundation for long-term growth. These advantages highlight why adopting effective analytics strategies is essential, a topic explored further in the next section on tools and workforce development.

Data Analytics Trends in the Gulf for 2026

The Gulf region, particularly the UAE, is riding the wave of digital transformation, with advanced analytics taking centre stage in shaping strategic decisions. A striking 84% of GCC organisations have integrated AI into specific functions, and 73% are employing it across their operations. This momentum is supported by a US$100 billion AI fund and rising investments in energy and technology sectors. The result? Gulf businesses are now translating data into tangible financial gains. For example, 11% of GCC organisations are classified as "value realisers", attributing at least 5% of their earnings directly to AI-driven insights and tools. This shift marks a turning point, positioning data as a critical strategic resource. Let’s dive into the innovations shaping this transformation, from real-time analytics to AI automation.

Real-Time Analytics and Edge Computing

Real-time data processing is revolutionising how businesses in the Gulf operate. Take Emirates Airline, for instance. By leveraging real-time analytics, the airline personalises offers and services on the fly, adapting to passenger preferences as they interact with its platforms. Similarly, DP World employs AI-driven predictive analytics to streamline cargo operations and optimise global supply chains.

The benefits extend beyond aviation and logistics. In banking, real-time fraud detection systems now flag suspicious transactions in milliseconds, while algorithmic lending decisions are made instantaneously using live data feeds.

Dubai's smart city initiatives showcase how real-time analytics can improve urban living. Traffic management systems analyse live data to ease congestion, while energy grids dynamically adjust consumption based on demand patterns. This level of agility is made possible through hybrid architectures that blend local edge computing with global cloud networks, ensuring compliance with data residency laws while maintaining processing efficiency.

AI-Driven Insights and Automation

The Gulf is moving beyond basic AI tools to adopt autonomous systems capable of complex decision-making. Today, 60% of GCC organisations use AI agents in some capacity, and 20% have implemented advanced "agentic AI" systems that can independently manage multi-step workflows.

A standout example is Saudi Aramco, which, in March 2024, unveiled a generative AI model with 250 billion parameters. This groundbreaking system analyses decades of geological data, drilling plans, and cost histories to optimise operations and predict equipment failures.

In another significant development, the Qatar Ministry of Communications and Information Technology entered a five-year agreement with Scale AI in February 2025. This partnership aims to deploy AI agents across government services, enhancing citizen engagement and driving forward-thinking data initiatives.

Arabic Natural Language Processing (NLP) is also gaining traction, enabling businesses to engage with Arabic-speaking customers more effectively. These localised AI models are helping organisations analyse feedback, automate customer support, and deliver personalised services in the region’s native language. Such advancements are breaking down barriers that previously hindered analytics adoption in Arabic-speaking markets, opening the door to tailored solutions in sectors like healthcare, energy, and urban development.

Industry-Specific Analytics Applications

Key sectors like healthcare, energy, and urban infrastructure are seeing targeted applications of advanced analytics in 2026. In healthcare, AI tools are driving predictive risk models for conditions like diabetes and cardiovascular diseases. AI-assisted medical imaging is also speeding up diagnoses, improving both patient outcomes and operational efficiency.

The energy sector is leveraging AI to manage the transition to renewable sources. AI-powered grid systems are optimising energy distribution, predicting maintenance needs, and integrating renewable sources like solar and wind more effectively. These efforts align with initiatives like UAE Net Zero 2050 and the Saudi Green Initiative, where businesses track carbon footprints and monitor sustainability progress through data-driven insights.

| Industry | AI-Driven Application | Key Benefit |

|---|---|---|

| Banking | Real-time fraud detection & lending | Lower risk and tailored financial solutions |

| Healthcare | Predictive disease risk modelling | Better patient care and hospital efficiency |

| Energy | AI-powered grid management | Smarter renewable energy integration |

| Logistics | Automated port operations | Enhanced supply chain efficiency |

| Smart Cities | Traffic and energy optimisation | Improved urban living and reduced congestion |

The UAE's strong digital infrastructure, featuring 35 data centres and the highest public cloud spending per employee at US$228, provides a solid foundation for scaling analytics solutions. Meanwhile, 72% of Saudi companies have already adopted strategies to implement emerging AI technologies. This robust ecosystem allows businesses to move from pilot phases to full-scale deployment in a matter of months, setting the stage for a data-driven future across the Gulf.

sbb-itb-058f46d

How to Implement Data Analytics: Tools, Strategies, and Workforce

Bringing data analytics into your organisation means aligning the right technology with your business objectives, equipping your team with the necessary skills, and fostering a culture that values data-driven decision-making. With 89% of UAE tech leaders reporting positive profitability impacts from AI and automation investments, the real challenge lies in execution. A key step is choosing analytics tools that align with your goals.

Selecting the Right Analytics Tools

Choose analytics platforms that directly address your business needs. For industries like healthcare or finance, prioritise tools that meet strict security and compliance requirements. For example, the Central Bank of the UAE mandates that Big Data models be "reliable, transparent, and explainable", making governance-focused platforms essential for financial institutions. Meanwhile, retail and e-commerce businesses benefit from tools that track omni-channel performance and predict customer behaviour. Energy and utilities sectors should look for platforms that offer predictive maintenance and sustainability reporting features.

Self-service BI tools are game-changers for empowering non-technical teams. Tools like Power BI, Tableau, and Qlik reduce IT report requests by 60% and cut decision turnaround times by 50%. This means your marketing team can build dashboards independently, and your operations manager can identify trends without waiting on IT support.

Before committing to a platform, conduct a maturity assessment. Survey your team to understand their frustrations and current data literacy levels. This will help you decide between no-code platforms, which are ideal for quick adoption by non-technical users, and low-code platforms, which suit more complex, enterprise-level needs. Opt for tools that integrate seamlessly with your ERP, CRM, or IoT systems to create a unified "single source of truth" across departments.

With 96% of UAE tech leaders planning investments in cloud and XaaS technologies, cloud-first analytics platforms are becoming the norm. Providers like Azure and AWS now operate local data centres in the UAE, ensuring both scalability and compliance with the country's data residency laws.

Training Your Workforce for Data Skills

Once the tools are in place, your team needs the skills to use them effectively. The Gulf region still faces a significant gap in analytics expertise - 73% of GCC organisations are at the lowest levels of analytics maturity. However, 70% of UAE technology leaders believe advancements in AI are helping to close this gap. The solution isn’t just hiring more data scientists; it’s about making analytics accessible to everyone in your organisation.

Begin with a 2–4 hour onboarding session to cover the basics of your chosen tools. Follow this with monthly workshops on advanced features and specific business use cases. Quarterly sessions should focus on teaching employees how to interpret data and turn insights into actionable strategies. This step-by-step training approach builds confidence and competence.

Identify "data champions" in each department - team members who are enthusiastic about analytics and willing to mentor their peers. This mirrors Dubai's Data Champions initiative, where departmental leads ensure compliance with the Dubai Data Law and act as liaisons for data-related matters. Peer-to-peer learning often feels more approachable than top-down training.

Modern platforms equipped with AI-assisted learning features, like natural language processing, make it easier for users to interact with data. Employees can ask questions in plain language and receive insights without needing coding expertise.

Make training engaging by incorporating gamification. Host internal analytics contests where teams solve real business challenges using data. Introduce "Data Hours" - monthly sessions where employees share their findings and success stories. These initiatives foster curiosity and collaboration. As your team grows more skilled, ensure they apply these insights to everyday processes to solidify a data-driven mindset.

Building a Data-Driven Culture

Leadership plays a pivotal role in fostering a data-driven culture. When executives use dashboards in meetings and demand data-backed justifications for decisions, teams are 85% more likely to incorporate data into their daily work. This aligns with the UAE's broader digital transformation goals, where leadership commitment is key.

"By fostering effective communication, enhancing tech literacy, and embracing change, UAE organisations are building the resilient foundations needed to lead in the era of rapid digital transformation." - Chi Ngwube, Partner, KPMG Lower Gulf

Start small with high-impact pilot projects rather than attempting an organisation-wide rollout. Focus on one department - such as sales, logistics, or operations - for an 8–12 week pilot phase. Aim for 70% user adoption within the test group before scaling up. Success stories from these early adopters can be more persuasive than executive mandates when encouraging broader implementation.

Establish a Centre of Excellence to oversee metrics, data quality standards, and governance. This ensures everyone works from consistent definitions and trusted datasets. Role-based access controls and "certified datasets" maintain security and reliability from the outset. In the UAE, where institutions are required to document frameworks for accountability and ethical outcomes, such governance is not optional - it’s essential.

Data-driven organisations are 23 times more likely to acquire new customers and 6 times more likely to retain them. With AI and analytics expected to contribute over 20% to the UAE's non-oil GDP by 2031, mastering implementation today positions businesses to lead their industries tomorrow.

Data Compliance and Governance in the Gulf

When it comes to leveraging analytics and training teams, compliance and governance form the backbone of responsible, data-driven growth. In the UAE, compliance isn't optional - it's a legal obligation. The introduction of Federal Decree Law No. 45 of 2021, also known as the Personal Data Protection Law (PDPL), on 2 January 2022 marked the first federal framework for personal data protection in the country. This law applies to any organisation processing the data of UAE residents, even if the servers are located outside the country. Businesses in free zones face additional layers of regulation: the Dubai International Financial Centre (DIFC) operates under DIFC Law No. 5 of 2020, while the Abu Dhabi Global Market (ADGM) follows the ADGM Data Protection Regulations 2021. Non-compliance comes with hefty penalties - fines can reach AED 102.8 million in ADGM and AED 184,000 in DIFC for failing to appoint a Data Protection Officer.

Certain industries face even stricter rules. In healthcare, for example, Federal Law No. 2 of 2019 prohibits the storage or transfer of medical records outside the UAE without prior authorisation. Financial institutions are regulated by Central Bank Law No. 14 of 2018, which requires Big Data models to be "reliable, transparent, and explainable". Additionally, banks and payment providers must report data breaches to the Central Bank within 72 hours and retain customer data for at least five years. These specific requirements come on top of the general PDPL obligations, making it crucial to fully understand the compliance landscape of your particular sector.

Data Governance Best Practices

A strong governance framework is essential to protect your investment in analytics. This begins with implementing a formal Data Management Framework (DMF). For financial institutions, this framework must be approved by senior management and the Board, supported by dedicated policies, funding, and independent validation. The Central Bank of the UAE emphasises:

"Accurate and representative historical data is the backbone of financial models. Institutions must implement rigorous and a comprehensive formal data management framework ("DMF") to ensure the development of accurate models."

Your DMF should focus on:

- Identifying data sources

- Regularly reviewing data quality

- Securing data with controlled access

- Maintaining a robust system infrastructure

Each dataset should have an assigned owner responsible for ensuring timely execution of these measures.

From a legal standpoint, maintaining a Record of Processing Activities (ROPA) is mandatory. This document outlines data categories, authorised roles, processing purposes, erasure procedures, and cross-border transfer rules. High-risk processing activities require the appointment of a Data Protection Officer. To safeguard individual identities, technical measures like pseudonymisation and anonymisation are highly recommended.

Understanding Regional and International Regulations

The UAE's data protection laws are closely aligned with global frameworks like the GDPR, adhering to principles such as fairness, transparency, and purpose limitation. Individuals, or "data subjects", have specific rights, including accessing their data, requesting corrections or deletion, and transferring their information to another controller. Consent must be obtained through clear, affirmative actions, and individuals should be able to withdraw it easily at any time.

Cross-border data transfers are allowed only if the receiving country meets adequate protection standards or specific legal exceptions apply. This means that even businesses located outside the UAE must comply if they handle data belonging to UAE residents. For businesses operating in the DIFC or ADGM, registration is a must. Fees range from approximately AED 918 to AED 4,588 in the DIFC and about AED 1,100 in the ADGM, with annual renewals required.

| Feature | UAE Federal PDPL | DIFC Law No. 5 of 2020 | ADGM Regulations 2021 |

|---|---|---|---|

| Primary Regulator | UAE Data Office | DIFC Commissioner | ADGM Commissioner of Data Protection |

| DPO Requirement | Mandatory for high-risk/large-scale sensitive data | Mandatory for high-risk activities | Mandatory for public authorities and large-scale monitoring |

| Breach Notification | Required to Bureau and Data Subject | Required to Commissioner and Data Subject | Required to Commissioner and Data Subject |

| Registration | No general registration requirement | Mandatory registration with Commissioner | Mandatory notification and fee payment |

Failing to notify regulators and affected individuals of a data breach that compromises privacy or security is a serious compliance risk. The UAE Data Office now acts as the federal regulator, tasked with preparing data protection policies, approving monitoring standards, and handling complaints. With the UAE advancing towards centralised electronic health records and enforcing stricter compliance across industries, embedding governance into your analytics systems from the outset is crucial. Not only does this protect your operations, but it also bolsters the trust necessary for successful data-driven initiatives.

Conclusion

Data analytics has become a cornerstone for businesses in the Gulf region. In the UAE alone, AI and analytics are projected to contribute over 20% to the non-oil GDP by 2031, with 55% of executives identifying it as their primary competitive advantage. This growing importance calls for clear, actionable strategies.

While ambition is essential, it must be paired with practicality. Start with the basics: focus on data quality and governance before diving into advanced AI models. As Mohamad Majid, Partner - Advisory at KPMG Lower Gulf, aptly puts it:

"By prioritising data-driven strategies and leveraging cloud platforms, UAE tech leaders are transforming challenges into opportunities for sustained growth and efficiency".

Accessibility is another critical factor. Ensuring data is available across your organisation is a priority for 37% of UAE tech leaders over the next year. This accessibility lays the groundwork for informed decision-making at every level.

Building a workforce capable of using these analytics tools is just as important. A data-driven culture thrives when the talent gap is addressed through training and the appointment of dedicated data champions. In fact, 89% of UAE tech leaders have already reported profitability gains from such initiatives. Aligning these efforts with broader goals, such as the UAE Vision 2031 framework, can amplify results.

Compliance is the bedrock of long-term success. Adhering to regulations like the PDPL and sector-specific guidelines from the Central Bank not only safeguards operations but also fosters trust. When approached strategically, regulatory compliance can evolve from a challenge into a competitive advantage.

As discussed earlier, success in the Gulf's digital transformation depends on pairing the right tools with skilled personnel. Whether your focus is banking, healthcare, retail, or energy, the resources and frameworks are ready. By leveraging these opportunities, your organisation can take a leading role in the region's rapidly evolving digital economy.

FAQs

How can businesses in the Gulf region use AI to boost efficiency?

Businesses in the Gulf have a tremendous opportunity to leverage AI for improving efficiency, cutting costs, and making more informed decisions. By automating routine tasks, processing vast amounts of data, and enabling real-time decision-making, AI allows organisations to save valuable time and enhance precision. For instance, machine learning can fine-tune supply chain operations, predict demand patterns, and identify potential problems before they escalate. Meanwhile, natural language processing is transforming customer service with chatbots that provide quick and effective support.

In the UAE, initiatives like the National AI Strategy 2031 are paving the way for innovation, giving businesses a framework to adopt AI thoughtfully. Here’s how companies can approach it:

- Build a robust data strategy: Establish a unified data repository to ensure AI models have the foundation they need to function effectively.

- Start small with pilot projects: Focus on areas like predictive maintenance, process automation, or inventory management to test AI’s potential.

- Prioritise transparency and compliance: Implement governance frameworks in line with guidelines from the Central Bank of the UAE to maintain ethical and regulatory standards.

- Expand successful initiatives: Scale up pilot projects that deliver results, integrating AI into existing systems like ERP and CRM for seamless operations.

With Wick’s expertise in AI-powered data analytics and tailored insights, businesses in the Gulf can achieve noticeable efficiency improvements while respecting local regulations and cultural norms.

What are the key data compliance requirements for businesses in the UAE?

The Federal Personal Data Protection Law No. 45 of 2021 serves as the cornerstone for data analytics compliance across the UAE. This law governs all personal data processing activities, whether conducted within the country or beyond its borders. It requires businesses to secure explicit consent from individuals before processing their data, except in cases where exceptions like public interest or legal obligations apply. The law also empowers individuals with rights such as correcting inaccurate information, limiting data processing, and controlling cross-border data transfers through either explicit consent or legally approved safeguards. Organisations are required to appoint a Data Protection Officer (DPO), maintain documented governance policies, and, if applicable, register sensitive activities with the UAE Data Office.

For businesses operating within the Dubai International Financial Centre (DIFC), compliance falls under the DIFC Data Protection Law No. 5 of 2020. This law enforces stringent measures, including conducting privacy impact assessments, promptly reporting data breaches, and adhering to robust privacy standards. Meanwhile, in the financial sector, the Central Bank of the UAE's Big Data and AI Guidelines provide clear directives on governance, accountability, and ethical practices for data usage.

Wick offers tailored support to Gulf-based businesses, helping them navigate these regulatory landscapes. From providing customised data analytics solutions to establishing governance frameworks and offering expert advice on appointing DPOs, Wick ensures businesses remain compliant with UAE regulations. Their approach promotes a secure and trustworthy digital ecosystem, enabling sustainable growth in the region.

What are the best tools for implementing data analytics in Gulf businesses?

Gulf businesses have access to a range of powerful tools to transform raw data into meaningful insights. Leading platforms like Microsoft Power BI, Tableau, and Looker stand out for their strong data visualisation features, seamless integration with cloud services such as Azure and AWS, and support for Arabic localisation. Other notable options include Snowflake, Alteryx, and Qlik, which provide advanced capabilities like predictive modelling and secure data warehousing.

When selecting a platform, it's essential to evaluate factors like scalability, compatibility with local cloud providers, and support for Arabic language and UAE-specific formats (e.g., AED 1,000.00 for currency and DD/MM/YYYY for dates). Ensuring smooth integration with existing systems, such as SAP or Oracle, is also key for maintaining efficient operations.

For businesses seeking tailored solutions, consultancies like Wick offer services to design customised analytics frameworks, develop interactive dashboards, and embed AI-driven insights that enhance performance across marketing, sales, and operations. With the right tools and strategies, Gulf businesses can build a strong, data-driven foundation to fuel sustainable growth.