Blog / Future of Decentralized Identity in Marketing

Future of Decentralized Identity in Marketing

Decentralized Identity (DCI) is reshaping how businesses handle customer data. Instead of relying on platforms like Google or Facebook, DCI gives individuals full control over their digital identities via secure wallets, backed by blockchain. This approach reduces data breaches, ensures privacy, and simplifies compliance with regulations like GDPR and UAE data laws.

For marketers in the UAE and GCC, DCI offers a streamlined way to verify customer details - like age or residency - without storing sensitive data. It also addresses key challenges such as the phaseout of third-party cookies, security risks in centralized databases, and the growing demand for user-controlled data.

Key benefits include:

- Faster onboarding: Reusable credentials cut onboarding time by 40%.

- Privacy-first targeting: Zero-Knowledge Proofs verify data without revealing unnecessary details.

- Cost savings: Reduces risks tied to data breaches and compliance fines.

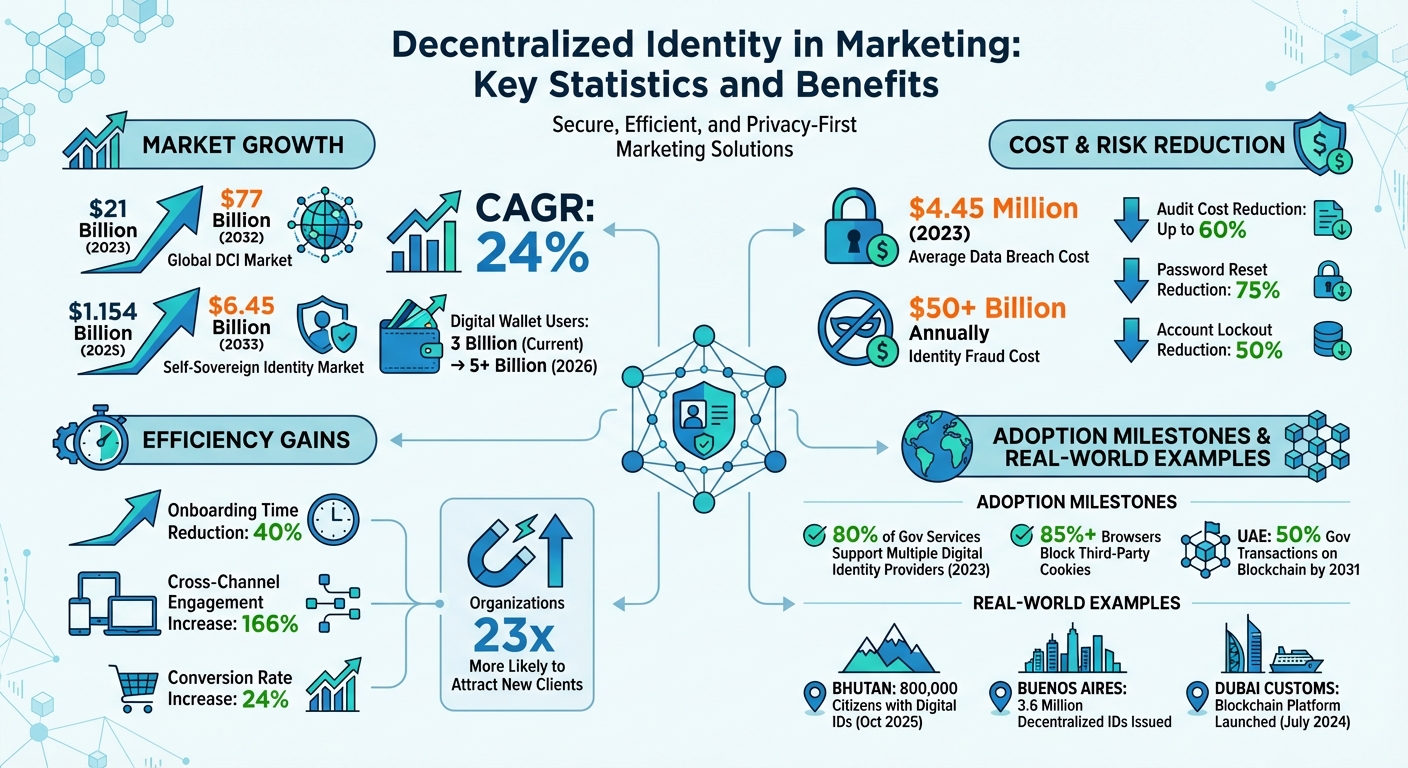

- Market potential: The global DCI market is expected to grow from $21 billion in 2023 to $77 billion by 2032.

Adopting DCI early in regions like the UAE, where digital transformation is advancing rapidly, can help brands build trust, improve user experiences, and align with local regulations. While challenges like integration costs and evolving standards exist, starting with high-friction areas like onboarding or loyalty programs can help businesses transition smoothly into this privacy-driven future.

Decentralized Identity in Marketing: Key Statistics and Benefits

What Decentralized Identity Means for Marketing

Decentralized Identity Explained

Decentralized identity (DID) is a new way to verify someone's identity without relying on central authorities like Google or Facebook. Right now, when you log in with platforms like those, they control your identity data. With DID, you’re in charge. Your identity is stored in a secure digital wallet on your device, protected by blockchain and cryptography.

This system relies on three key elements: blockchain (or distributed ledger technology), DIDs, and verifiable credentials. Instead of companies saving sensitive documents like your passport or Emirates ID, they just validate your credentials against a blockchain. This shift significantly reduces the risk of data breaches.

"The design enables the controller of a DID to prove control over it without requiring permission from any other party" – W3C DID Working Group

For marketers, this means a major change: moving from owning customer data to requesting access to it. This approach builds trust and simplifies compliance. On top of this, self-sovereign identity (SSI) takes things further, giving users even greater control over their digital identities.

Self-Sovereign Identity (SSI) and Verifiable Credentials

Building on the concept of decentralized identity, self-sovereign identity (SSI) allows individuals to fully manage their digital identities. Instead of storing your data on central servers, you keep it on your device and decide what to share, when, and with whom.

This is made possible through verifiable credentials (VCs) - secure digital versions of documents like your driving licence, degree certificate, or proof of residency. Here’s how it works: a trusted entity (the Issuer), such as the UAE government or a bank, creates a digital credential and signs it cryptographically. You (the Holder) store it in your digital wallet. When someone (the Verifier) - like a marketer - needs to confirm details about you, they verify the credential against the blockchain without ever contacting the original issuer. This "trust triangle" eliminates the need for companies to store sensitive data, slashing both risks and costs.

For customers, this means less hassle. Instead of filling out the same forms repeatedly, they can share verified credentials they already have, cutting onboarding time by 40%. And with digital wallet usage projected to exceed 5 billion users by 2026, this isn’t a far-off dream - it’s already becoming reality.

Why Marketers Should Care About Decentralized Identity

Decentralized identity offers marketers tamper-proof, accurate information directly from trusted sources. This eliminates the need for unreliable third-party data brokers or manual data entry errors. Beyond efficiency, it’s a game-changer for the 850 million people worldwide who currently lack access to digital services due to the inability to prove their identity. DID makes identity portable and accessible, opening doors to new markets.

From a compliance perspective, the advantages are clear. In 2023, the average cost of a data breach reached US$4.45 million - the highest in nearly 20 years. Over half of these breaches involved customer personal data. By adopting a "verify, don’t store" strategy, marketers can confirm customer information without holding sensitive data, reducing liability under regulations like GDPR and the UAE’s data protection laws. With identity fraud costing organisations over US$50 billion annually, SSI can also cut audit costs by up to 60%.

Most importantly, privacy is becoming a competitive advantage. Customers are increasingly aware of how brands use their data, and they’re choosing those that respect their privacy. Decentralized identity allows businesses to demonstrate this commitment clearly.

"Decentralized identity puts people back in control of their personal information. Instead of handing over full documents to every app or platform, users can share only what's needed and keep the rest private" – Phillip Shoemaker, Executive Director of Identity.org

In a region like the UAE, where digital transformation is advancing at lightning speed, adopting decentralized identity early can give your brand an edge. It strengthens customer trust, enhances engagement, and integrates seamlessly into modern marketing tools, driving growth while reducing risks.

Privacy and Compliance Benefits for Marketing

Privacy-First Identity Verification

Decentralised identity uses zero-knowledge proofs (ZKPs) to verify customer details without exposing sensitive information. Imagine running an age-restricted campaign for luxury spirits in Dubai - you need to confirm customers are "over 21" without storing copies of their Emirates ID or passport. With ZKPs, customers can prove their age through their digital wallet without sharing the actual document.

Through selective disclosure, customers only share what’s necessary. For instance, they might prove UAE residency without revealing their full personal details. Everything else stays private. This approach significantly lowers the risk of data breaches since there’s no centralised database filled with sensitive information for hackers to exploit.

"Zero-Knowledge Proofs represent a remarkable cryptographic advancement, offering a robust approach to managing digital identity securely and privately... It opens the possibility of sharing more by sharing less." – Yi Tong, Investor, Galaxy

For marketers, this means reduced liability while still achieving precise targeting. You can confirm that someone belongs to a specific demographic or watched an ad without accessing their entire browsing history. With more than 85% of browsers now blocking third-party cookies, ZKPs and selective disclosure offer a privacy-conscious alternative that keeps campaigns effective. These privacy measures also help businesses meet strict global and UAE-specific data regulations.

Meeting Global and Local Data Regulations

Decentralised identity not only enhances privacy but also ensures compliance with both global and UAE data protection laws. It aligns seamlessly with GDPR and UAE-specific regulations, such as Federal Decree-Law No. 45 of 2021. Its "verify without storing" principle allows organisations to confirm credentials via blockchain without holding onto user data. This supports GDPR’s data minimisation requirement, which mandates collecting only what’s absolutely necessary.

UAE data residency rules require that personal data stays within the country. Decentralised identity addresses this by storing data locally - either on the user’s device or within UAE-specific digital systems like UAE Pass. When a customer shares a verifiable credential, it comes directly from their personal wallet, ensuring the data remains within UAE borders. By integrating tools like UAE Pass and Emirates ID online validation, marketers can meet local regulatory requirements while maintaining seamless operations.

The GDPR’s "Right to be Forgotten" becomes easier to manage when users control their own data. Since businesses only hold verification records and not the actual data, users can revoke access or delete their credentials whenever they choose. This reduces compliance challenges and minimises the risk of fines.

For companies operating in the UAE, adopting national systems like UAE Pass and the Emirates ID online validation gateway ensures identity verification is both secure and compliant with Central Bank of the UAE (CBUAE) guidelines. As the global decentralised identity market is expected to grow from around US$21 billion in 2023 to an estimated US$77 billion by 2032, early adoption offers businesses a competitive edge - not just in meeting regulations, but also in building customer trust.

Better Customer Experience Through Decentralized Identity

Simplifying Customer Onboarding

Decentralized identity transforms onboarding into a matter of seconds. Instead of endlessly filling out forms or uploading documents for every new service, customers verify their identity once with a trusted issuer - like a bank or government. This generates a verifiable credential stored in their digital wallet, which they can reuse across various platforms.

For instance, reusable KYC credentials can shrink onboarding time from days to mere minutes. In the UAE, a simple QR code scan could instantly share necessary credentials - such as Emirates ID verification or proof of residency - without the hassle of manual data entry. Additionally, passwordless authentication replaces traditional usernames and passwords with cryptographic proofs, removing the frustration of account creation and password recovery.

Global examples highlight how this technology is reshaping digital verification. In October 2025, Bhutan transitioned to Ethereum, enabling instant digital verification for 800,000 citizens. Similarly, Buenos Aires issued decentralized IDs to 3.6 million people, simplifying access to government services. These advancements provide a glimpse of what could soon enhance UAE's digital services.

"Decentralized identity makes the verification process faster and more user-friendly. Individuals can verify once and reuse credentials when needed, eliminating the need to remember multiple passwords or repeatedly upload documents." – Identity.org

This streamlined approach not only accelerates onboarding but also gives users greater control over their personal data.

Giving Customers Control Over Their Data

Decentralized identity isn’t just about speed - it’s about empowering users to take charge of their data. Instead of relying on corporations to manage their information, customers become their own identity providers, deciding when and with whom to share their data. Personal information remains securely stored on the user’s device, minimizing the risks associated with large-scale data breaches.

With selective disclosure, users share only the specific details required for a transaction. This transparency builds trust, as customers can maintain a "verifiable history" in their digital wallets. This history allows them to track who accessed their data and for what purpose.

The shift toward decentralized identity is already gaining momentum. By 2023, 80% of government services requiring authentication supported access through multiple digital identity providers. With around three billion payment wallets in use globally - a number projected to surpass five billion by 2026 - the groundwork for widespread identity integration is already laid. For marketers, this means customers who feel secure sharing verified data are more likely to engage deeply and remain loyal over time.

"Instead of 'renting' your digital identity from organisations that profit from your data, you own it. It becomes portable, private, and always under your control." – 1Kosmos

At Wick, we see decentralized identity as a game-changer for creating secure, personalised customer experiences. By weaving these innovations into a cohesive digital strategy, businesses can foster trust and build long-term relationships in today’s rapidly evolving digital world.

Industry Applications of Decentralised Identity in Marketing

E-commerce and Retail

Decentralised identity is reshaping how retailers in the GCC region connect with their customers. Instead of requiring users to create separate accounts for every platform, a single portable digital identity simplifies the process. This reduces the need for repeated sign-ups, which often lead to checkout drop-offs.

By adopting passwordless systems, retailers can cut account lockouts by 50% and password resets by 75%. The result? A smoother shopping experience and fewer abandoned carts.

Selective disclosure is another game-changer. It allows customers to confirm details like being "over 18" or a "UAE resident" without sharing their full Emirates ID. Retailers can also create unified loyalty programmes across multiple brands in the GCC, rewarding customers without relying on fragmented databases. Additionally, cryptographically signed credentials help prevent synthetic identity fraud and fake account creation, safeguarding both profits and reputation.

With the UAE Central Bank planning to phase out SMS-based OTP codes by 2026, retailers must shift to biometric and decentralised authentication systems. Brands that aim to stay ahead should integrate solutions like UAE Pass and align with UAE Verify standards to remain compliant and simplify customer onboarding.

This streamlined approach not only enhances customer experiences but also sets the stage for similar advancements in other regulated industries.

Healthcare and Financial Services

Decentralised identity is making waves in healthcare and financial services, addressing challenges like fraud prevention, faster verification, and secure data management. Financial institutions, for example, can automate KYC and AML processes by enabling customers to share pre-verified credentials via QR codes. This not only ensures compliance with Central Bank of the UAE (CBUAE) guidelines but also reduces regulatory audit expenses.

A noteworthy example is Bhutan’s migration of its National Digital Identity system to Ethereum in October 2025, giving 800,000 citizens access to verifiable credentials. By March 2025, 234,000 of these digital IDs allowed users to confirm their age or citizenship without revealing unnecessary details.

Healthcare providers also benefit from decentralised identity through seamless data transfers between facilities, even across GCC borders, eliminating data silos. Patients can use Zero-Knowledge Proofs to verify specific details - such as having a valid prescription - without exposing their entire medical history. Similarly, in Buenos Aires, over 3.6 million residents have received decentralised identity credentials through the QuarkID system. This enables peer-to-peer sharing of essential documents like birth and vaccination records without third-party tracking.

By 2023, more than 80% of government services requiring authentication supported access through multiple digital identity providers. For marketers in finance and healthcare, this shift opens doors to privacy-first targeting and personalised campaigns, fostering deeper customer engagement while staying compliant with regulations.

Public Services and Real Estate

In public services and real estate, decentralised identity plays a critical role by creating tamper-proof audit trails for high-value transactions. Blockchain-based systems provide immutable, time-stamped records for property deals and government applications. For instance, in July 2024, Dubai Customs launched a blockchain platform to streamline clearance and shipping procedures, showcasing the GCC’s commitment to transparency and efficiency through this technology.

In real estate, selective disclosure allows potential buyers to verify their residency or financial credentials without sharing their entire identity. Integration with UAE Verify and DIFC ensures secure digital identities during property transactions. The UAE National Blockchain Strategy aims to transition 50% of all government transactions to blockchain systems by 2031, creating opportunities for marketers to engage users through privacy-respecting, personalised channels.

The GCC’s app analytics market is projected to grow from US$195 million in 2024 to over US$1.18 billion by 2033, with a compound annual growth rate of 22.1%. Decentralised identities, paired with cross-channel marketing strategies, can boost engagement by 166% and increase conversion rates by 24%. For public services and real estate, this evolution means faster KYC processes, better data security, and marketing campaigns that respect user privacy while delivering measurable results - all contributing to a more secure and efficient digital ecosystem.

sbb-itb-058f46d

Adding Decentralised Identity to Your Marketing Technology Stack

Technology Integration Steps

Integrating decentralised identity into your marketing technology stack can boost both privacy and efficiency. To get started, you’ll need to familiarise yourself with the core components: Decentralised Identifiers (DIDs), Verifiable Credentials (VCs), and a verifiable data registry - this could be a blockchain or a distributed database. The process begins with generating enough randomness to create cryptographic keys, which are essential for initiating a DID Create operation. Next, a DID Resolver is needed to produce DID Documents containing public keys and service endpoints.

Marketers must also determine their role in the Trust Triangle. You could act as an Issuer (providing credentials such as loyalty rewards), a Holder (managing your organisation’s identity), or a Verifier (validating customer credentials during onboarding). A smart approach is to start small, perhaps piloting the system in high-friction areas like KYC (Know Your Customer) or customer onboarding, before scaling it across your entire stack. For businesses in the UAE, aligning these integrations with local digital identity regulations can help streamline customer onboarding while ensuring compliance.

To further enhance privacy and security, support protocols like SD-JWT or Zero-Knowledge Proofs (ZKPs). These allow you to verify user attributes - such as age or residency - without exposing the full dataset. Additionally, integrating biometric verification (like fingerprints or facial recognition) directly on the user’s device ensures that the person presenting the credential is its rightful owner.

Here’s a quick overview of the key steps, their technical actions, and the marketing benefits they bring:

| Integration Step | Technical Action | Marketing Benefit |

|---|---|---|

| Identity Creation | Generate entropy and cryptographic keys | Establishes a secure, unique link between brand and consumer |

| Credential Issuance | Sign digital certificates (VCs) for users | Enables portable loyalty and membership proofs |

| Verification Setup | Integrate DID Resolvers and ZKP protocols | Allows instant, privacy-preserving customer verification |

| Wallet Integration | Connect to mobile ID wallets via OIDC | Simplifies onboarding and eliminates password use |

These steps lay the foundation for incorporating AI into your marketing strategy, enabling precise and personalised customer experiences.

Combining Decentralised Identity with AI and Personalisation

Once decentralised identity is integrated, it can work seamlessly with AI to enhance personalisation efforts. Verifiable Credentials ensure that your AI models rely on accurate, trusted data rather than fragmented or unreliable third-party sources. By using cryptographically signed credentials from trusted issuers, AI tools can process verified information, creating a unified and user-controlled dataset. This eliminates the need for customers to re-register at every touchpoint, ensuring a consistent and smooth experience across your entire marketing stack.

Zero-Knowledge Proofs (ZKPs) take privacy to the next level. For example, they allow you to verify that a customer is over 18 without revealing their exact birthdate. AI tools can then use these verified attributes to deliver personalised content, but only with the user’s explicit consent through their identity wallet.

Reusable KYC credentials, such as "Gateway Passes", can also make onboarding much smoother. Customers no longer need to submit the same documents repeatedly, reducing friction and saving time. These wallet-centric systems empower users while feeding your AI tools with consistently accurate data.

With the decentralised identity market projected to grow to US$77 billion by 2032 and digital wallet adoption expected to surpass 5 billion users by 2026, this presents a massive opportunity for marketers to lead the charge in creating secure, personalised, and user-friendly experiences.

The Future of Decentralised Identity in Marketing

Market Growth and Business Opportunities

The decentralised identity market is on a fast track to growth. By 2025, the global Self-Sovereign Identity (SSI) market is expected to hit US$1.154 billion, skyrocketing to US$6.45 billion by 2033. That’s a compound annual growth rate (CAGR) of 24%. This surge is being fuelled by regulatory mandates, increasing government adoption, and a growing consumer demand for privacy-focused solutions.

In the UAE and the broader MENA region, the momentum is particularly strong. Governments across the Middle East are actively working on national ID wallet initiatives, aiming for rapid mainstream adoption. These efforts are creating a regulatory environment that actively encourages private sector participation. Similarly, in Europe, the eIDAS2 regulation, passed in 2024, requires all member states to introduce digital identity wallets by 2026. It also mandates that large private platforms accept these wallets for authentication.

For businesses, this presents a golden opportunity. Early adopters of digital identity solutions stand to gain a competitive edge. Research shows that organisations leveraging digital identity effectively are 23 times more likely to attract new clients. Beyond customer acquisition, companies can cut costs tied to data breaches and compliance, freeing up resources to enhance customer experiences. Jan Vanhaecht, Global Digital Identity Leader at Deloitte, underscores this point:

"Digital identity should be at the core of any leading, data-driven organisation".

With digital wallets already widespread, the infrastructure for identity credentials is largely in place. By embracing decentralised identity now, marketers can position their brands as trustworthy and privacy-conscious, ahead of broader market adoption. However, this path is not without its obstacles.

Addressing Adoption Challenges

Despite the opportunities, implementing decentralised identity systems comes with challenges. One major hurdle is integrating decentralised identifiers (DIDs) into existing CRM systems. This process often demands blockchain expertise and skilled security professionals - resources that many organisations currently lack.

Another challenge is the lack of fully established standards. As of January 2026, the W3C DID v1.1 specification remains in a "Working Draft" phase. While the technology is advancing, its incomplete standardisation creates uncertainty, making it difficult to choose protocols that will remain compatible in the long term. To navigate this, marketers should prioritise open standards from organisations like W3C, ISO, and the OpenID Foundation, ensuring both global and regional interoperability.

Cost is another factor to consider. Blockchain fees and scalability issues can strain budgets. However, these costs may be offset by savings in areas like reduced data storage liabilities, simplified compliance processes, and better customer acquisition outcomes.

To tackle these challenges, start small. Test decentralised identity solutions in areas where friction is high, such as customer onboarding or loyalty programmes, before scaling across your entire marketing tech stack. Conduct a detailed review of your current data practices to identify which customer data points could be replaced with verifiable credentials. Finally, collaborate with technology providers who understand both the marketing and technical aspects of digital identity. This ensures your implementation aligns with local regulations while remaining globally interoperable.

Achieving business goals with decentralized identity

Conclusion

Decentralised identity is reshaping how marketers connect with their customers. By giving individuals control over their own data wallets, brands can shift away from intrusive tracking and fragmented login systems. Instead, they can embrace a model that respects privacy while still delivering tailored experiences. This shift doesn’t just safeguard privacy - it also builds trust and boosts operational efficiency. It’s more than just meeting regulatory requirements; it’s about fostering trust in a world where data security is critical.

Embracing decentralised identity offers multiple benefits: reduced risk of data breaches, simplified compliance, and stronger consumer trust. The global market for decentralised identity is forecasted to hit an impressive US$77 billion by 2032. Companies that adopt this technology early gain a distinct advantage, as the "verify, don't store" approach minimises liability and aligns seamlessly with regulations like GDPR and the UAE’s data protection frameworks.

For marketers in the UAE and the wider region, the timing is ideal. Experts highlight that decentralised identity frees data from traditional silos, empowering users. This wallet-driven approach not only removes onboarding hurdles but also supports token-gated loyalty programmes and allows customers to share only the data necessary for each interaction through selective disclosure. Early adoption positions brands to build privacy-focused, competitive customer relationships in the UAE.

To overcome common integration hurdles, start by piloting decentralised identity solutions in areas with high customer friction, such as onboarding processes or loyalty initiatives. Use open standards from organisations like the W3C and the OpenID Foundation, and collaborate with technology providers who understand both marketing goals and technical needs. Focusing on high-impact areas first helps create a digital ecosystem built on trust and efficiency. The companies that succeed will be those that see decentralised identity not as a mere compliance measure but as a cornerstone for transparent, trust-driven customer relationships in a privacy-conscious era.

The future of marketing hinges on earning permissioned access to the right data at the right time. Decentralised identity is making that future a reality today.

FAQs

How does decentralized identity enhance customer privacy and security?

Decentralized identity offers a way to boost privacy and security by putting individuals in charge of their personal data. Instead of handing over all their information, people can choose to share only what’s absolutely necessary, keeping the rest private. This approach significantly lowers the risk of data breaches and misuse.

What makes this possible is blockchain-based cryptography. By removing the reliance on centralised databases - prime targets for cyberattacks - this system keeps sensitive data secure. Information is verifiable without being stored in a single, vulnerable location. This means users can feel confident their data is safe while still enjoying smooth and secure interactions with businesses.

What challenges do businesses face when implementing decentralized identity systems?

Adopting decentralised identity (DI) systems comes with its fair share of hurdles for businesses. One major challenge is interoperability. Many DI solutions operate on different, often incompatible protocols, making it tricky to integrate systems and share credentials smoothly across platforms. This often leads to hefty investments in custom integrations to bridge these gaps.

Another pressing issue is scalability. Blockchain networks that power DI systems can face limitations like slow transaction speeds and high costs, especially as the number of users and verification requests increases. These bottlenecks can create inefficiencies, particularly for businesses scaling their operations.

Security and privacy management also bring added layers of complexity. While DI puts users in control of their data, businesses must ensure cryptographic keys are securely managed and that they comply with regional regulations, such as the UAE’s stringent data protection laws. This creates a delicate balance between empowering users and meeting legal obligations.

Lastly, there’s a shift in the business model to consider. Traditional marketing strategies often rely on aggregated user data, but DI enables individuals to limit or revoke access to their personal information. This makes it harder for businesses to justify investments in DI without a clear return on investment.

At Wick, we address these challenges head-on. By leveraging our Four Pillar Framework, we provide businesses with DI-compatible solutions that prioritise privacy and data-driven strategies. We implement standardised protocols and scalable systems tailored specifically to the UAE market. This allows businesses to offer personalised experiences while respecting user data sovereignty and staying ahead of evolving digital trends.

What are the benefits of decentralised identity for marketers in improving customer engagement and ensuring compliance?

Decentralised identity puts individuals in charge of their personal data, giving marketers access only to the information they need for specific campaigns. This not only builds trust but also simplifies sign-ups and logins, reducing friction. The result? Higher conversion rates and more meaningful interactions with customers. People feel safer knowing their data isn’t stored in a centralised system, while marketers can avoid the risks associated with holding sensitive data, significantly cutting the chances of breaches.

With decentralised identifiers (DIDs), staying compliant with privacy laws like the EU GDPR, California CCPA, and UAE data protection regulations becomes much more straightforward. First-party data, collected with clear consent, can be securely managed without relying on complicated cookie systems. This allows marketers to deliver AI-powered personalised experiences that respect privacy and meet legal requirements.

Wick’s expertise in integrating decentralised identity into its Four-Pillar Framework offers brands a way to create secure, trust-driven customer journeys. By blending identity verification with marketing automation, analytics, and AI personalisation, marketers in the UAE can boost engagement, honour cultural expectations around data privacy, and ensure compliance with both local and international standards.