Blog / E-Commerce Legal Requirements for GCC Payment Gateways

E-Commerce Legal Requirements for GCC Payment Gateways

If you're running an e-commerce business in the GCC, payment gateway compliance is non-negotiable. Failing to meet legal standards can lead to fines, licence suspension, or even business closure. Here's a quick breakdown of what you need to know:

- Key Regulations: Businesses must comply with the UAE's Retail Payment Services and Card Schemes Regulation, AML/CFT laws, and the UAE Personal Data Protection Law.

- Fines and Penalties: Violations can result in fines ranging from AED 1,000 to millions, depending on the severity.

- PCI DSS Compliance: All e-commerce businesses handling cardholder data must meet PCI DSS standards, including encryption, firewalls, and quarterly scans.

- AML and KYC: Implement robust frameworks to monitor transactions, verify customer identities, and report suspicious activity.

- Data Localization: Payment and personal data must be stored within the UAE or other GCC countries, with strict controls on cross-border data transfers.

- Cross-Border Payments: Adhere to international standards like FATF and local licensing requirements for currency exchange and remittances.

Compliance isn't just about avoiding penalties - it protects your business, builds customer trust, and ensures smooth operations in the GCC's growing e-commerce market.

PCI DSS Compliance: Protecting Payment Data

PCI DSS Compliance Levels and Requirements for GCC E-Commerce Merchants

In the GCC, PCI DSS compliance stands as a critical pillar of e-commerce security. Any business that stores, processes, or transmits cardholder data must comply with these standards.

PCI DSS is built around six control objectives and 12 specific requirements. These include implementing firewalls, encrypting data during transmission, limiting physical access to cardholder information, and establishing formal security policies. In the UAE, the Central Bank (CBUAE) strengthens these standards through its Retail Payment Services and Card Schemes Regulation, which outlines strict guidelines for technology risk and information security. Understanding your compliance obligations starts with assessing your transaction volume.

What PCI DSS Requires from Your Business

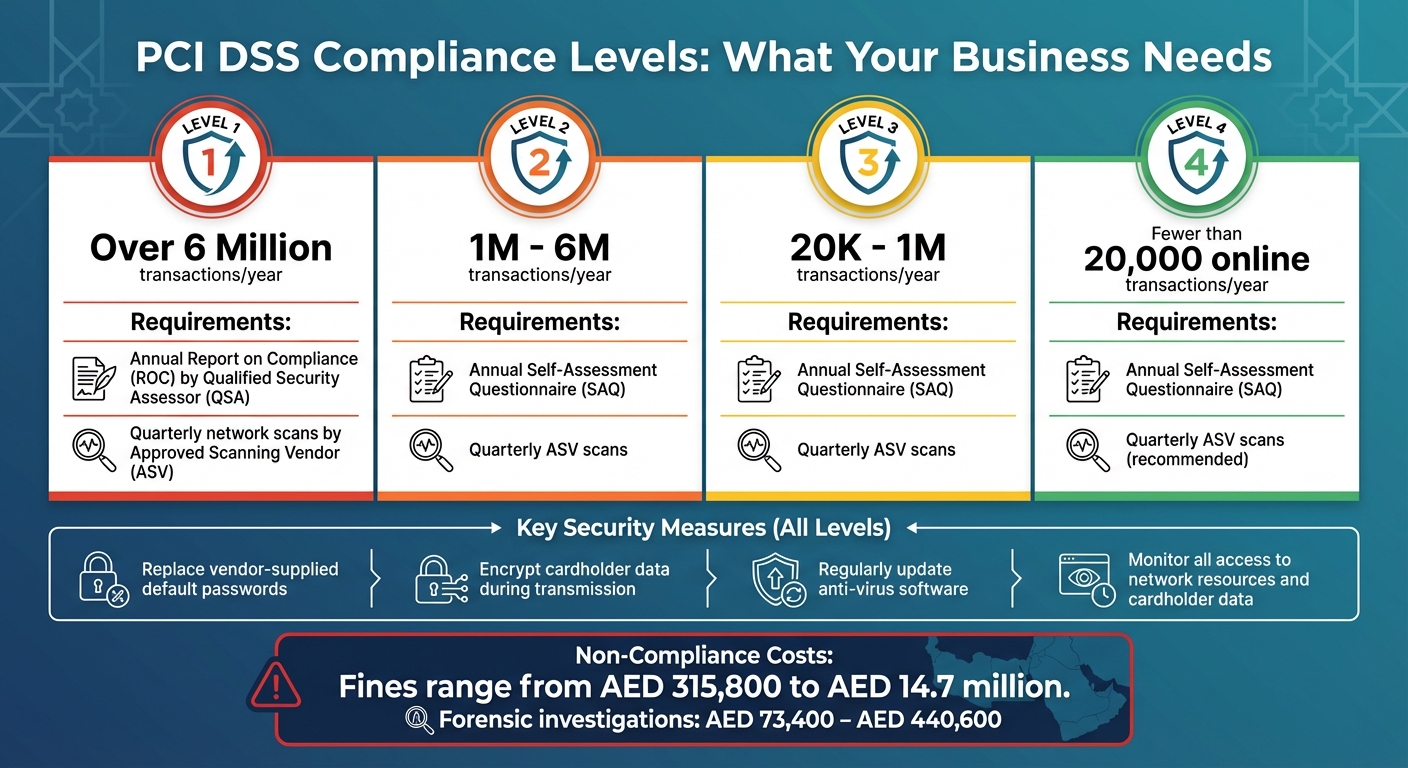

Your compliance level is determined by the volume of transactions your business processes annually. PCI DSS classifies merchants into four levels:

- Level 1: For businesses handling over 6 million transactions yearly. These merchants must complete an annual Report on Compliance (ROC) conducted by a Qualified Security Assessor (QSA) and undergo quarterly network scans by an Approved Scanning Vendor (ASV).

- Level 2: For businesses processing between 1 million and 6 million transactions annually. They are required to submit an annual Self-Assessment Questionnaire (SAQ) and perform quarterly scans.

- Levels 3 and 4: For businesses with lower transaction volumes. These merchants also need to complete annual SAQs and quarterly scans.

In addition to these validation requirements, businesses must take several critical steps to secure cardholder data:

- Replace all vendor-supplied default passwords.

- Encrypt cardholder data during transmission.

- Regularly update anti-virus software.

- Monitor and track all access to network resources and cardholder data.

Physical security measures are equally crucial. Access to locations where cardholder data is stored must be strictly controlled. To simplify compliance, consider implementing tokenisation through hosted payment fields or mobile SDKs. This ensures sensitive data is sent directly to a PCI-validated gateway, allowing businesses to qualify for SAQ A.

| Compliance Level | Annual Transaction Volume | Validation Requirements |

|---|---|---|

| Level 1 | Over 6 million | Annual ROC by QSA; Quarterly ASV scan |

| Level 2 | 1 million to 6 million | Annual SAQ; Quarterly ASV scan |

| Level 3 | 20,000 to 1 million | Annual SAQ; Quarterly ASV scan |

| Level 4 | Fewer than 20,000 (online) | Annual SAQ; Quarterly ASV scan (recommended) |

These measures outline the technical and physical safeguards all merchants must put in place.

How PCI DSS Compliance Protects Your Business

Since 2005, over 10 billion consumer records have been exposed in more than 9,000 data breaches. In 2019 alone, nearly 32% of businesses reported experiencing a data breach or cyberattack. PCI DSS aims to reduce these risks by safeguarding your Card Data Environment, protecting against fraud, identity theft, and session hijacking.

The financial fallout from non-compliance can be devastating. Fines can range from AED 315,800 to AED 14.7 million. If a breach occurs, mandatory forensic investigations could cost anywhere from AED 73,400 to AED 440,600, depending on your transaction volume. Beyond monetary penalties, non-compliance could result in the loss of credit card processing privileges, effectively halting your e-commerce operations.

However, compliance is about more than just avoiding fines. It builds trust with your customers. When shoppers know their payment data is protected by industry-standard security measures, they are more likely to complete their purchases and return. This trust is especially vital in the GCC's expanding e-commerce sector, where credibility plays a major role in success.

AML and KYC Requirements for GCC Payment Gateways

E-commerce businesses in the GCC must go beyond securing payment data by implementing Anti-Money Laundering (AML) and Know Your Customer (KYC) frameworks. These measures are essential for protecting businesses from financial crimes and ensuring compliance with regulatory standards. The stakes are high: an estimated 2% to 5% of global GDP is laundered annually, yet authorities manage to seize only about 2% of these illicit funds. Payment gateways play a crucial role in countering these risks.

Meeting AML Compliance Standards

AML compliance in the GCC is built around a risk-based approach. Payment gateways must identify, assess, and understand specific risks related to money laundering and terrorist financing, especially when launching new payment products or services. Measures should be tailored to the unique risk profile of the business.

A key element of AML compliance is transaction monitoring. Businesses must establish internal policies, and for larger operations, automated systems to detect unusual transactions that deviate from a customer’s typical patterns. According to the Central Bank of the UAE:

"LFIs with a larger scale of operations are expected to have in place automated systems capable of handling the risks from an increased volume and variance of transactions."

Additionally, businesses must regularly screen their customer databases and all transaction parties against the UN Consolidated List and the UAE Local Terrorist List. A compliance officer with the right expertise must oversee the AML framework. If suspicious activity is detected, a Suspicious Transaction Report (STR) or Suspicious Activity Report (SAR) must be filed with the Financial Intelligence Unit, and the customer must not be informed to avoid "tipping off".

Failure to meet AML standards can result in severe penalties. Administrative fines for inaccurate record-keeping range from AED 50,000 to AED 5,000,000, while failing to submit an STR can lead to fines between AED 100,000 and AED 1,000,000. Criminal penalties may include imprisonment for 1 to 10 years and fines of up to AED 5,000,000. For instance, in February 2024, a Dubai-based company formation provider faced heavy penalties after a Ministry of Economy review revealed issues with goAML registration, risk assessment, and compliance violations. The company had to engage consultants to restore compliance and avoid licence suspension.

| Violation Type | Administrative Fine (AED) |

|---|---|

| Not registering on goAML | 50,000+ |

| No risk assessment file | 50,000+ |

| Not appointing a compliance officer | Up to 1,000,000 |

| Failure to submit STR/SAR | 100,000 – 1,000,000 |

| Failure to retain records (5 years) | 50,000 – 5,000,000 |

Once robust AML measures are in place, the next step is implementing effective KYC processes.

Setting Up KYC Verification Processes

KYC involves several steps: verifying customer identity, identifying beneficial owners, understanding the nature of the business relationship to establish risk profiles, and ongoing transaction monitoring. The Central Bank of the UAE underscores the importance of this:

"Adequate CDD/KYC is the cornerstone for licensed financial institutions when establishing an understanding of customers... and expected activity for which to detect suspicious activity in the future."

Verification requirements depend on transaction thresholds. Customer Due Diligence (CDD) is mandatory for occasional transactions of AED 55,000 or more or for wire transfers of AED 3,500 and above. For identity verification, businesses can use national digital identity systems like UAE Pass, which employs biometric facial recognition for remote verification, or validate Emirates ID cards through platforms provided by the Federal Authority for Identity and Citizenship or the UAE Pass app.

Risk-based tiering is essential for due diligence. Use Simplified Due Diligence (SDD) for low-risk customers, such as government entities or publicly listed companies, and Enhanced Due Diligence (EDD) for high-risk individuals like Politically Exposed Persons (PEPs) or high-net-worth clients.

For high-risk activities, such as updating personal data or processing large transactions, implement multi-factor authentication (MFA) with biometric verification. The "four-eye" principle, where one employee enters customer data and another verifies it, can help reduce errors and fraud. Use standardised onboarding forms for different customer segments to ensure consistent data collection. If a customer provides false information or KYC cannot be completed, refuse the transaction and file an STR with the Financial Intelligence Unit. Lastly, maintain all records for at least five years to allow the reconstruction of transactions and ensure quick access for authorities when needed.

Data Storage and Localization Rules in the GCC

With AML and KYC processes now clarified, it's time to address a crucial aspect: where and how payment data is stored. In the GCC, particularly in the UAE, strict data residency regulations significantly influence payment gateway infrastructure.

Understanding Data Localization Laws

The Central Bank of the UAE mandates that Payment Service Providers (PSPs) store personal and payment data entirely within the country. As highlighted by Clifford Chance:

"The UAE Central Bank's Retail Payment Services and Card Schemes Regulation imposes data protection obligations on entities providing retail payment services or operating card schemes in the UAE and provides that personal and payment data must be stored and maintained in the UAE."

This regulation also applies to Stored Value Facilities (SVF) licensees, requiring them to keep customer identification and transaction records within the UAE. These records must be retained for a minimum of five years, with secure backups maintained at a separate local site. Access to these records is strictly limited to the customer, the Central Bank of the UAE (CBUAE), approved authorities, or through UAE court orders.

Saudi Arabia enforces similar rules. For instance, the Saudi Central Bank (SAMA) requires specific approval for cloud services hosted outside the Kingdom. Additionally, insurance companies operating in the country must ensure customer personal data remains within Saudi borders. The Capital Market Authority (CMA) also stipulates that registered entities using cloud-computing services must host those services locally in Saudi Arabia.

Cross-border transfers of sensitive financial data are tightly controlled, requiring explicit approval from the CBUAE and customer consent. While the UAE Federal Decree-Law No. 45 of 2021 outlines a general data protection framework, it excludes personal banking and credit data, which fall under the stricter jurisdiction of the CBUAE.

Adapting Your Payment Infrastructure

To comply with these regulations, payment systems must meet specific localization requirements. Here's how to align your infrastructure:

- Relocate Data Servers: Ensure your primary servers are located within the UAE and establish a secondary backup at a separate local site.

- Appoint a Compliance Manager: Assign a senior manager to oversee data protection, ensuring they report directly to top management. This role involves monitoring compliance with storage regulations and working closely with technical teams.

- Submit Risk Assessments: Before launching operations, provide the CBUAE with independent assessments of technology risks, payment security, and business continuity. These assessments must be conducted by independent experts who are not part of your organisation.

- Respond to Data Breaches: Card schemes are required to notify the CBUAE within 72 hours of discovering any data breach.

Additionally, classify your data systematically. Create clear distinctions between payment data (financial details), personal data (identifiable information), and sensitive payment data (security credentials). Apply appropriate security measures for each category. Maintain a detailed record of cross-border data transfers, authorised access, and erasure processes.

sbb-itb-058f46d

Cross-Border Payment Compliance

Once you've ensured local data storage compliance, the next step is managing international transactions. While domestic compliance lays the groundwork, cross-border transactions require additional controls, particularly with currency handling and adhering to multi-jurisdictional regulations.

Currency Conversion and Exchange Regulations

In the UAE, businesses offering currency exchange or cross-border money transfer services must obtain a licence from the Central Bank. The licensing framework is divided into four categories:

| Licence Category | Permitted Activity | Min. Paid-up Capital (Sole Est./Partnership) |

|---|---|---|

| Category I | Currency Exchange, Remittances, Salary Processing | AED 10 Million |

| Category II | Currency Exchange, Remittances | AED 5 Million |

| Category III | Currency Exchange only | AED 2 Million |

| Category IV | Digital Remittances only (No physical outlets) | AED 25 Million (LLC only) |

For businesses operating under Category IV licences, currency conversion is allowed solely as part of digital remittance processes. Separate cash-in or cash-out activities are prohibited. If you're running a mobile or web-based remittance platform, your business must be an LLC with AED 25 million in paid-up capital and provide a matching bank guarantee.

These licensing rules extend the domestic compliance requirements to international remittance services. To manage exchange rate risks, businesses should open Hedge Accounts with regulated institutions, especially when dealing with high transaction volumes. Additionally, a bank guarantee of at least 5% of the average monthly inward and outward remittance value (calculated over six months) must be maintained. Before launching services like payroll cards or digital remittances, it's mandatory to secure a Central Bank Letter of No Objection (LNO).

Meeting International Payment Standards

Handling cross-border payments goes beyond local currency regulations - it also involves meeting global compliance standards. Transactions must adhere to both GCC regulations and international frameworks like the Financial Action Task Force (FATF) and the Principles for Financial Market Infrastructures (PFMI). Transparency is key: payment gateways must include complete identifying information for each transaction to prevent obscured payment chains that hide the identities of payers and payees.

The Central Bank emphasises the importance of transparency:

"Unlike cross-border wires, which carry full identifying information, the bank will frequently only see the customer's transactions with the payment network itself, rather than their location or ultimate destination."

If you partner with an Instant Money Transfer Service (IMTS) provider, ensure they are listed in the Central Bank's IMTS register and meet reporting and compliance requirements. For transactions within the Arab region or GCC, consider leveraging systems like BUNA (Arab Regional Payment System) and AFAQ (GCC RTGS). These systems operate under agreed rules for transaction currencies and exchange rates.

In January 2026, the Central Bank of the UAE (CBUAE) signed a Memorandum of Understanding with China's Cross-Border Interbank Payment System (CIPS). This partnership aims to improve payment efficiency and reduce costs. H.E. Saif Al Dhaheri, Assistant Governor for Banking Operations and Support Services, noted:

"This MoU underpins both countries' efforts to cultivate strategic partnerships and reinforce our commitment to strengthening financial, trade, and investment cooperation... create innovative financial solutions for cross-border payments settlement, and facilitate transactions and reduce costs."

Regulations in this area are continually evolving. For instance, Project Aber, a collaboration between the CBUAE and the Saudi Central Bank (SAMA), explored the use of a dual-issued digital currency for cross-border settlements. By employing distributed ledger technology, the project addressed inefficiencies in existing interbank systems and benchmarked its results against other central bank initiatives.

Conclusion: Meeting Payment Gateway Compliance in the GCC

Steps to Achieve Compliance

To meet compliance requirements in the GCC, businesses need to align with key standards like PCI DSS, AML, KYC, and data protection laws. For credit card transactions, implementing PCI DSS standards is a must. Additionally, integrating local payment systems such as Mada and KNET ensures compatibility with regional preferences. Compliance with data protection laws, including UAE Federal Decree Law No. 45 of 2021, is equally critical. In Saudi Arabia, ZATCA regulations, including the mandatory e-invoicing (Fatoorah) system, must be followed.

Appointing a Data Protection Officer (DPO) for high-risk data processing activities is another essential step. Using technologies like tokenisation and automated VAT-compliant invoicing can help reduce both PCI DSS requirements and manual errors . To simplify VAT and ZATCA filings, businesses should integrate compliant accounting and invoicing platforms like Zoho Books or Xero.

Heather Scurti from EBizCharge emphasises the importance of ongoing efforts:

"PCI compliance is an ongoing process that requires regular evaluations and assessments of current systems and practices. It's not a 'set it and forget it' project - it's a continual effort to keep cardholder data safe".

Businesses should also establish breach notification protocols as mandated by UAE law. These steps not only ensure regulatory compliance but also help build a foundation of trust with customers.

Building Customer Confidence Through Compliance

Adhering to compliance standards is not just about avoiding penalties; it's a way to earn customer trust. For example, 85% of internet users have stated they would stop using a website if it lacked proper security measures. By following PCI DSS standards and implementing secure transaction protocols, businesses in the GCC can assure consumers that their sensitive data is well-protected.

Failure to comply with these regulations can result in hefty fines, reputational harm, and even placement on the MATCH (Member Alert to Control High-Risk Merchants) List, which can disqualify businesses from obtaining new merchant accounts for years. On the other hand, adopting robust security practices like visible SSL/TLS certificates, two-factor authentication, and tokenisation creates a secure environment that enhances brand credibility in the competitive GCC market . Collaborating with established GCC payment providers that are already PCI DSS compliant can further ease the regulatory burden while ensuring customers enjoy a seamless and secure payment experience .

FAQs

What legal requirements must e-commerce payment gateways in the GCC meet?

E-commerce payment gateways in the GCC are required to follow specific regulations to ensure secure and compliant operations. Among these, PCI-DSS compliance is a must for safeguarding payment data. Additionally, businesses must obtain a Central Bank licence to operate retail payment services and manage card schemes, as mandated by the UAE Retail Payment Services and Card Schemes Regulation (C 15/2021). For those offering payment-token services, securing a licence or registration under the Payment Token Services Regulation (C 2/2024) is essential.

Another critical requirement is adherence to the UAE’s Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) framework, aimed at preventing financial crimes. By following these regulations, businesses not only enhance customer trust but also avoid potential legal issues and operational setbacks.

What are the benefits of PCI DSS compliance for my e-commerce business?

PCI DSS compliance plays a crucial role in keeping sensitive cardholder data safe and ensuring secure payment transactions. Following these standards helps your e-commerce business minimise the chances of data breaches and fraud, offering protection not just for your customers but also for your brand's reputation.

Adhering to PCI DSS standards also strengthens customer confidence. Shoppers are far more likely to trust and purchase from platforms that make security a priority. Beyond trust, compliance shields your business from hefty fines and penalties tied to non-compliance, allowing for smoother daily operations and steady growth in the highly competitive GCC e-commerce landscape.

What are the consequences of not complying with AML and KYC regulations in the GCC?

Non-compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations in the GCC, especially in the UAE, can result in serious consequences. These range from substantial administrative fines to criminal charges and even imprisonment.

According to UAE Cabinet Resolution No. 132 of 2023, businesses that fail to adhere to AML/KYC requirements face significant legal and financial risks. Staying compliant is not just about avoiding penalties - it’s also about upholding trust and credibility within the regulatory system.