Blog / How Multi-Touch Attribution Improves ROI Analysis

How Multi-Touch Attribution Improves ROI Analysis

Multi-touch attribution (MTA) is a game changer for analysing marketing performance in the UAE, where the digital landscape is highly diverse, with 99% of people online and 95% using mobile devices. Unlike outdated single-touch models, MTA assigns credit to all customer touchpoints - like social ads, search clicks, and emails - giving a clearer picture of what drives revenue. Businesses using MTA report up to 30% better ROI by reallocating budgets based on accurate data.

Key takeaways:

- What is MTA? Tracks and credits multiple touchpoints in the customer journey.

- Why it matters? It helps businesses stop guessing and start spending on what works.

- Challenges in the UAE: Device switching, bilingual campaigns, and offline touchpoints.

- Models to choose from: Linear (equal credit), Time Decay (recent touchpoints matter more), U-Shaped (first and last steps), and Data-Driven (AI-based).

- Compliance: Aligning with the UAE’s Personal Data Protection Law (PDPL) requires first-party, consent-based tracking.

Marketing Measurement for Beginners | Part 2 - Data-Driven MTA (Multi-Touch Attribution)

Multi-Touch Attribution Models Explained

Multi-Touch Attribution Models Comparison Guide for UAE Marketers

Single-Touch vs Multi-Touch Attribution

Single-touch attribution models give 100% of the credit for a conversion to just one interaction - usually the first touchpoint (First-Touch) or the last one before a purchase. While straightforward, this approach oversimplifies the customer journey and often distorts ROI. For example, if a customer clicks on a Google Ad right before making a purchase, that ad might get all the credit, even though earlier interactions - like discovering the brand on social media - played a role.

Multi-touch attribution takes a more balanced approach, spreading credit across all the touchpoints that influenced a customer’s decision. Instead of focusing on just one channel, it acknowledges that multiple channels contribute at different stages of the journey. This method is especially relevant for businesses in the UAE, where 60% of marketing leaders report challenges in measuring ROI across digital channels. Transitioning to multi-touch attribution can help ensure marketing budgets are allocated more effectively.

Types of Multi-Touch Attribution Models

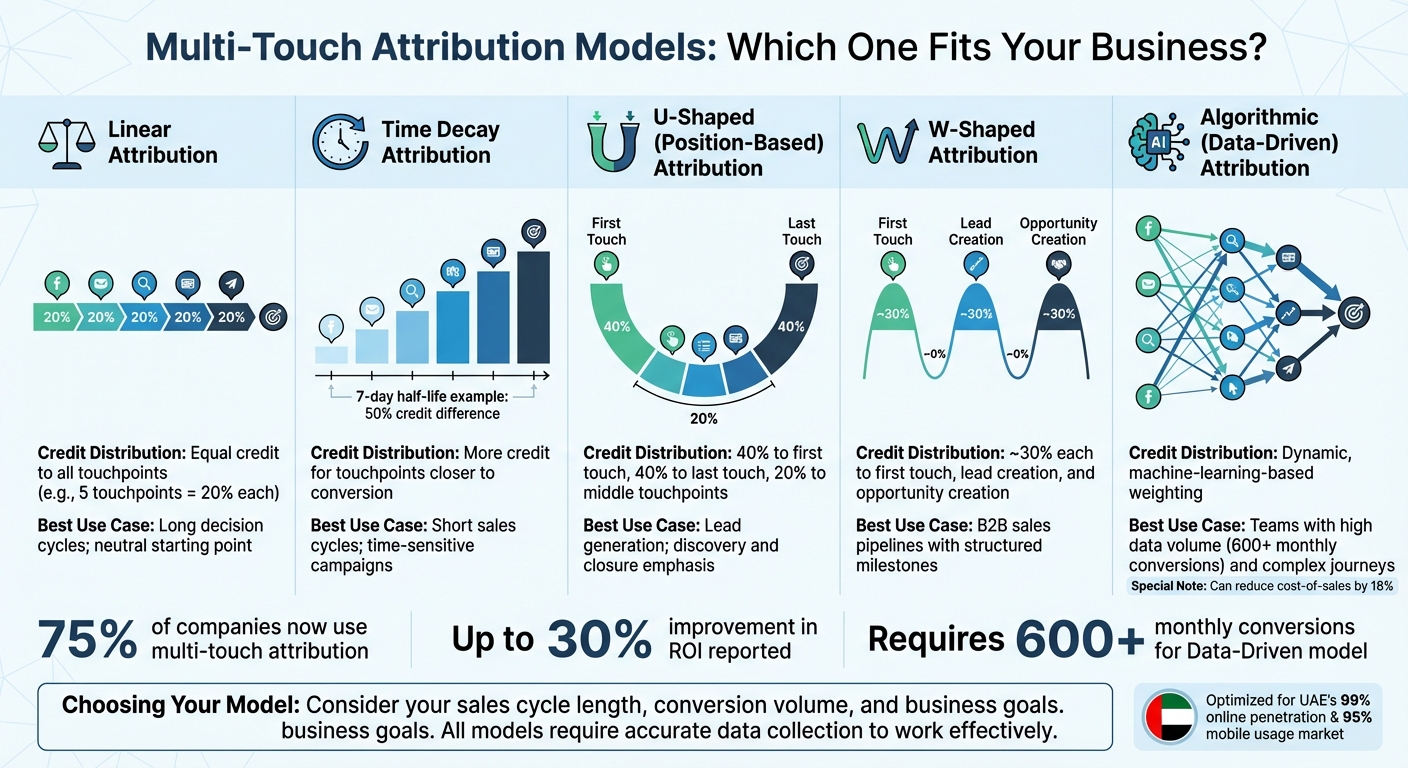

- Linear Attribution: This model gives equal credit to every touchpoint in the customer journey. For example, if a customer interacts with five channels before purchasing, each channel gets 20% of the credit. It’s ideal for businesses just starting with multi-touch attribution or those with long decision-making cycles. However, it doesn’t highlight which touchpoints were most impactful.

- Time Decay Attribution: This model places more emphasis on interactions closer to the conversion. For instance, in a seven-day half-life model, a touchpoint occurring seven days before the purchase gets about 50% of the credit compared to one on the day of the purchase [3, 19]. It’s particularly useful for short sales cycles or time-sensitive campaigns.

- Position-Based (U-Shaped) Attribution: This model gives priority to the first and last interactions, typically assigning 40% of the credit to each, while the remaining 20% is split among the middle interactions. It works well for lead-generation campaigns where both initial discovery and final closure play critical roles.

- W-Shaped Attribution: This model focuses on three key milestones: the first touch, lead creation, and opportunity creation. Each milestone typically gets around 30% of the credit, with the rest distributed among other interactions. It’s especially useful for B2B businesses with structured sales pipelines.

- Algorithmic (Data-Driven) Attribution: Using machine learning, this model analyses historical data to dynamically assign credit to each touchpoint. It provides an objective view of channel performance and has, in some cases, helped marketers lower their cost-of-sales by 18%. However, it requires a high volume of data and technical expertise.

| Model Type | Credit Distribution | Best Use Case |

|---|---|---|

| Linear | Equal credit to all touchpoints | Long decision cycles; neutral starting point |

| Time Decay | More credit for touchpoints closer to conversion | Short sales cycles; time-sensitive campaigns |

| U-Shaped | 40% to first and last, 20% to middle | Lead generation; discovery and closure emphasis |

| W-Shaped | ~30% each to first touch, lead, and opportunity creation | B2B sales pipelines |

| Algorithmic | Dynamic, machine-learning-based weighting | Teams with high data volume and complex journeys |

Choosing the right model depends on your business goals and available data, but all require accurate data collection to work effectively.

Data Requirements for Attribution in the UAE

For multi-touch attribution to succeed in the UAE, precise and compliant data collection is essential. Given the high mobile usage in the region, ensuring seamless tracking across devices - mobile, tablet, and desktop - is critical. Tools like unified ID systems or login-based tracking can help address the challenge of fragmented data when users switch devices.

With the UAE’s Personal Data Protection Law (PDPL) aligning closely with GDPR, marketers must prioritise first-party data strategies. This includes using first-party cookies, server-side tracking, and consent-based data collection to adapt to the decline of third-party cookies. These steps are vital for maintaining attribution capabilities in the long term.

Additionally, effective cross-channel tracking involves tagging campaigns with UTMs, setting up tracking pixels across platforms, and integrating offline data sources like CRM systems, call tracking, and location-based interactions. This is especially important in industries like luxury retail or high-value services, where offline touchpoints - such as showroom visits or phone consultations - play a major role in influencing purchases. Without incorporating this offline data, marketers risk missing key parts of the customer journey, leading to incomplete ROI analysis.

Setting Up a Multi-Touch Attribution Framework

Setting Business Goals and ROI Metrics

Before diving into multi-touch attribution, it's essential to define clear success metrics. In the UAE, key conversion events could include e-commerce purchases, lead form submissions, WhatsApp clicks, or "contact us" interactions. With an impressive 99% online penetration and 95% mobile usage in the region, tracking mobile-specific actions is a must.

For businesses outside the e-commerce space, assign monetary values in AED to each lead. For instance, if one out of every 10 leads converts into a customer worth AED 1,000, then each lead holds a value of AED 100. This approach helps you calculate metrics like Return on Ad Spend (ROAS) and Customer Acquisition Cost (CAC) with precision. To ensure accurate ROI measurement, integrate your ad spend data from platforms like Google Ads, Meta, TikTok, and LinkedIn directly into your analytics system.

Retailers with physical stores should consider a blended ROI approach, combining online and in-store revenue. Many customers in the UAE browse online but finalise their purchase in-store. Using tools like Google Ads' location extensions can help track store visit conversions and provide a clearer picture of overall performance. To maintain fairness and transparency, establish governance rules to prevent departments from manipulating attribution models for budget protection. Regularly review your framework - at least quarterly - to adapt to any strategic shifts.

Once you've nailed down your ROI metrics, the next step is to visually map out how customers engage with your brand across both digital and offline channels.

Mapping Customer Journeys in the UAE

With success metrics defined, it's time to map every customer interaction to identify all the touchpoints that drive value. In the UAE's dynamic digital landscape, this means covering platforms with high penetration rates such as YouTube (reaching 94% of internet users), TikTok (118% of adults due to multiple accounts), Instagram, Snapchat, and LinkedIn. Don't overlook WhatsApp interactions - tag Click-to-WhatsApp campaigns separately to avoid losing them in "Direct" traffic.

Offline touchpoints are equally important. Phone calls, in-store visits, and physical store systems often play a significant role, especially in industries like insurance, automotive, or real estate. To bridge the gap, use AI-powered call tracking to digitise phone conversation data and integrate it into your online journey maps. Cross-channel tracking is key - use UTM parameters, tracking pixels, and unique identifiers to connect interactions across platforms seamlessly.

Consistency in reporting is crucial. Standardise all data using Gulf Standard Time (GST). Since mobile usage is particularly high in the UAE, monitor mobile performance closely. Dive into device breakdown reports to compare conversion rates and time-lag differences between mobile and desktop users.

Preparing and Standardising Data

Once your customer journey is mapped out, focus on preparing and standardising your data for accurate tracking and attribution. Implement Google Analytics 4 (GA4) to track user journeys across web and mobile apps, marking key actions - like purchases, lead forms, and WhatsApp clicks - as conversions. For retailers, syncing Point-of-Sale (POS) systems with Customer Relationship Management (CRM) platforms ensures that in-store transactions are attributed to digital campaigns.

To maintain consistent attribution, use standardised UTM parameters across all non-Google platforms like Meta, TikTok, LinkedIn, and Snapchat. Test conversion events in DebugView to confirm accurate data tracking. For social platforms, manually upload or link cost data into your primary analytics tool to calculate ROAS and cost per lead.

Establish robust data governance guidelines to ensure accuracy and consistency across departments. Align your tracking practices with the UAE's Personal Data Protection Law (PDPL) by using anonymised, consent-based data collection methods. Conduct quarterly audits to refine your attribution model as new marketing channels emerge or consumer behaviours shift. Reliable, standardised data is the foundation for trustworthy ROI measurement.

| UAE Data Source | Standardisation Method | Key Metric to Track |

|---|---|---|

| Mobile Apps/Web | GA4 Event Tracking | Conversion Value (AED) |

| Physical Stores | POS to CRM Sync | In-store Sales Attribution |

| Social (TikTok/Meta) | UTM Parameters | ROAS / Cost per Lead |

| Click-to-WhatsApp Tags | Lead Quality / Engagement | |

| Local ERPs | API Integration | Customer Lifetime Value (LTV) |

sbb-itb-058f46d

Implementing Multi-Touch Attribution for ROI Analysis

Choosing the Right Attribution Model

Picking the right attribution model depends on factors like your sales cycle length, the volume of conversions, and the complexity of your marketing channels. This choice should align with your ROI goals and customer journey insights. For example:

- Time Decay works well for fast-paced e-commerce or flash sales with sales cycles under seven days.

- U-Shaped models are ideal for medium cycles lasting one to four weeks.

- W-Shaped models suit more intricate B2B journeys.

- For businesses with over 600 monthly conversions, Google's Data-Driven Attribution uses machine learning to uncover patterns in customer behaviour.

Interestingly, about 75% of companies now use multi-touch attribution, with many reporting up to a 30% boost in ROI thanks to smarter budget allocation.

Connecting and Validating Marketing Data

Start by integrating all your marketing channels into a single, unified system built on a standardised data framework. This means connecting tools like GA4, your CRM, and advertising platforms to create a reliable "single source of truth". Consistent use of UTM parameters across campaigns is crucial for accurate tracking. For businesses in the UAE, this includes tagging digital touchpoints like Meta ads, TikTok campaigns, LinkedIn posts, and Click-to-WhatsApp links.

Don’t overlook offline interactions. Log activities like trade show visits, phone calls, and in-store consultations directly into your CRM to ensure your attribution model captures non-digital contributions. Regular audits - every three to six months - can help you catch issues like duplicate entries or inconsistent naming conventions.

"Multi-touch attribution replaces the question 'Which single channel gets credit?' with 'How much did each channel contribute?'" – Cedric Yarish, AdManage

Using Attribution Insights to Improve ROI

Leverage attribution insights to make smarter budget decisions. For instance, if upper-funnel channels like YouTube awareness campaigns are driving conversions but don’t get last-click credit, consider reallocating AED from last-click channels to support these efforts.

To confirm your decisions, use incrementality testing methods like holdout experiments or geo-split tests. These tests can validate whether a specific channel is genuinely driving additional conversions. A great example is Domino’s, which, in 2025, boosted its YouTube ROI by 45% by pairing brand awareness campaigns with performance campaigns. This approach highlighted how upper- and lower-funnel activities can complement each other.

Presenting clear attribution data can turn budget discussions into strategy-driven conversations. Track metrics like ROAS and Customer Acquisition Cost in AED across all channels. Studies show that businesses using multi-touch attribution see efficiency gains of 15% to 30%, and nearly 60% of marketers report better alignment between sales and marketing teams. These insights allow you to continuously refine your marketing investments across the entire customer journey.

Benefits and Challenges of Multi-Touch Attribution

Main Benefits of Multi-Touch Attribution

Multi-touch attribution (MTA) brings several advantages that can significantly enhance return on investment (ROI). One of the standout benefits is its ability to deliver precise ROI measurement. By distributing credit across all touchpoints that contribute to a conversion, MTA allows businesses to accurately assess the performance of individual channels, campaigns, or even specific creatives in AED.

Another major advantage is better budget allocation. With a clear understanding of which channels drive meaningful conversions, marketers can redirect funds from underperforming areas to those that yield the most impact. Companies using multi-touch models have reported up to a 30% improvement in ROI thanks to smarter spending decisions. Additionally, MTA uncovers cross-channel synergy, showing how different platforms - like Instagram, Google Search, and WhatsApp - work together to influence conversions. This is particularly relevant in the UAE, where 99% of the population is online, and 95% access the internet via mobile devices.

Real-world examples highlight the impact of MTA. For instance, Italian footwear brand Geox integrated its social data into Google's Search Ads 360 and adopted data-driven attribution. This approach led to a 6% boost in return on ad spend (ROAS) and cut campaign management time by 30%. Similarly, Crédit Agricole Italia transitioned from last-click attribution to a data-driven model, discovering the importance of Display ads for upper-funnel engagement. The shift resulted in an 8% increase in incremental conversions, an 8% drop in cost per lead, and an 85% rise in conversions attributed to Display ads.

Common Implementation Challenges

Despite its benefits, implementing MTA in the UAE comes with unique hurdles. One challenge is the fragmented customer journey, as users frequently switch between devices and platforms. For example, platforms like TikTok (which reaches 118% of adults due to multiple accounts) and YouTube (reaching 94% of internet users) make it difficult to track a consumer's full conversion path.

Privacy regulations also pose a challenge. Updates limiting third-party cookies and stricter privacy laws, such as the UAE's Personal Data Protection Law (PDPL), reduce visibility into user behaviour, particularly for view-through conversions on social platforms. To navigate this, businesses must prioritise consent-based and anonymised tracking. Tools like Google Analytics 4, which uses machine learning to bridge data gaps while adhering to privacy standards, can be invaluable.

Another issue is offline tracking gaps. MTA typically focuses on digital interactions, often overlooking offline touchpoints. For industries such as real estate, automotive, and insurance, where offline interactions play a critical role, AI-powered call tracking software can help capture phone conversions and integrate them into CRM systems. Additionally, platform bias can distort results, as platforms like Meta and Google often claim credit for the same conversion, inflating ROI figures. To counter this, employing a neutral third-party attribution tool can provide an unbiased view of performance.

How Wick Supports MTA Implementation

Wick addresses these challenges with its comprehensive framework. By relying on its Four Pillar Framework, Wick tackles MTA obstacles through its Capture & Store and Tailor & Automate pillars. This approach consolidates data from GA4, CRM systems, and advertising platforms into a unified view, ensuring consistent and accurate ROI tracking across all touchpoints.

Wick also facilitates Customer Data Platform (CDP) implementation, enabling businesses to standardise data collection and maintain consistent UTM tagging across campaigns. This is particularly crucial for UAE-specific touchpoints like Click-to-WhatsApp links, Snapchat ads, and TikTok campaigns. Using these insights, Wick's marketing automation services develop tailored campaigns that align with customers' positions in their journey, optimising the impact of each interaction. For businesses aiming to adopt advanced Data-Driven Attribution, Wick provides strategic consulting to ensure the necessary data volume and infrastructure are in place. By integrating these services, Wick helps businesses refine their ROI analysis without disrupting their broader marketing strategies.

Conclusion: Improving ROI with Multi-Touch Attribution

Multi-touch attribution offers UAE businesses a fresh approach to analysing ROI by assigning value to every interaction that contributes to a conversion - from the first Instagram ad to the final WhatsApp click. In the UAE's fast-paced, mobile-driven market, where digital engagement is nearly universal, tracking every customer touchpoint is essential. Without this approach, businesses risk making budget decisions based on partial data, often over-investing in channels that merely finalise sales while overlooking those that spark interest and create demand. This comprehensive perspective lays the groundwork for actionable insights that fuel strategic growth.

The financial benefits are compelling. Companies using multi-touch attribution report up to a 30% improvement in ROI and efficiency gains ranging from 15% to 30% in marketing performance. By revealing the true contributions of each channel, this method enables smarter spending based on actual customer behaviour rather than relying on platform-reported metrics. It also eliminates the common issue of platforms like Meta and Google both claiming credit for the same conversion, which can artificially inflate ROI figures.

For businesses in the UAE, multi-touch attribution provides a much-needed edge in an increasingly fragmented digital landscape. Moreover, it aligns with the UAE's Personal Data Protection Law (PDPL) by leveraging privacy-first tools like GA4, which depend on first-party data. This ensures compliance while delivering accurate insights.

Implementing this approach requires the right infrastructure. Wick's Four Pillar Framework simplifies this process through its Capture & Store and Tailor & Automate pillars, which consolidate data from various sources into a unified view. This allows businesses to monitor UAE-specific touchpoints such as Click-to-WhatsApp links and Snapchat ads. The result? Precise, actionable ROI analysis that supports both short-term marketing adjustments and long-term strategic planning.

With 75% of companies now adopting multi-touch attribution models, the question isn’t whether you should implement it - it’s how quickly you can act to maintain your competitive edge. By embracing multi-touch attribution, businesses can not only uncover the true drivers of conversions but also position themselves for sustainable growth in the UAE's dynamic market.

FAQs

What makes multi-touch attribution more effective than single-touch models for analysing ROI?

Multi-touch attribution offers a clearer picture of ROI by distributing credit across all the interactions a customer experiences on their journey. Every touchpoint - whether it's an ad, an email, or a social media post - gets recognised for its role in driving conversions. This method helps marketers see how different efforts work together to influence outcomes.

On the other hand, single-touch models simplify things too much by assigning all the credit to just the first or last interaction. This can leave marketers with an incomplete understanding of what’s really working. By embracing multi-touch attribution, you can make smarter, data-backed decisions and fine-tune your marketing strategies for better, measurable results.

What challenges do businesses in the UAE face when implementing multi-touch attribution?

Businesses in the UAE face several hurdles when implementing multi-touch attribution models. One of the biggest challenges is figuring out how to allocate credit to each touchpoint across various digital channels and devices, including smartphones, tablets, and desktops. This task becomes even trickier given the popularity of local platforms like YouTube, TikTok, Instagram, and WhatsApp.

Another significant issue is managing data from extended customer journeys, which often stretch over weeks and involve multiple platforms. Problems such as data silos, inconsistent data formats, and the need to tailor attribution models to local events like Ramadan or National Day add to the complexity. On top of that, businesses must adhere to the UAE's Personal Data Protection Law (PDPL), which emphasises user privacy and requires explicit consent for tracking customer behaviour.

Wick addresses these challenges by offering a data-driven approach. They unify fragmented data, adapt attribution models to reflect the UAE’s unique cultural and linguistic landscape, and ensure compliance with local regulations.

How can businesses in the UAE comply with the Personal Data Protection Law when using multi-touch attribution?

To align with the UAE's Personal Data Protection Law when using multi-touch attribution, businesses need to focus on securing user consent. This means being upfront about how data is collected and used, ensuring transparency at every step. Using privacy-first tools, like analytics platforms that anonymise user data, can support compliance efforts. Moreover, companies should implement clear data retention and processing policies that adhere to legal standards, promoting both accountability and trust in their marketing practices.